In the quest for quality hires, talent acquisition leaders often spend considerable time extracting DNA from the company’s top performers in hopes of cloning the outstanding workers. After reviewing performance goals and synthesizing multiple data inputs, line managers and recruiters collaborate to craft tightly honed hiring profiles for each position. Next, it’s up to the recruiter to source the candidates, which is a critical step in the process, because sourcing plays a vital role in achieving quality of hire (a topic explored in depth in the October Journal of Corporate Recruiting Leadership).

Targeted sourcing is the second step in hiring top performers, as shown in this chart (click to enlarge) illustrating the complete quality of hire process, from Taleo Research.

Most recruiters instinctively return to the same source when searching for candidates, because historically the source has produced a quick response from a large number of prospects with the required skills. But a deeper dive into employee turnover statistics and performance ratings might result in some surprises about the quality of the candidates secured through each source, according to Andrew Carges, vice president of worldwide talent acquisition for Success Factors.

Carges says that he found first-year turnover was high for employees sourced through agencies, during his experience at SuccessFactors and in his previous roles as a talent leader. A closer review as to why those employees left revealed that many had a history of job-hopping, and he concluded that employees represented by recruiters were frequently hunting for new opportunities and had easy access to other positions. Now he evaluates source effectiveness and its impact on quality of hire.

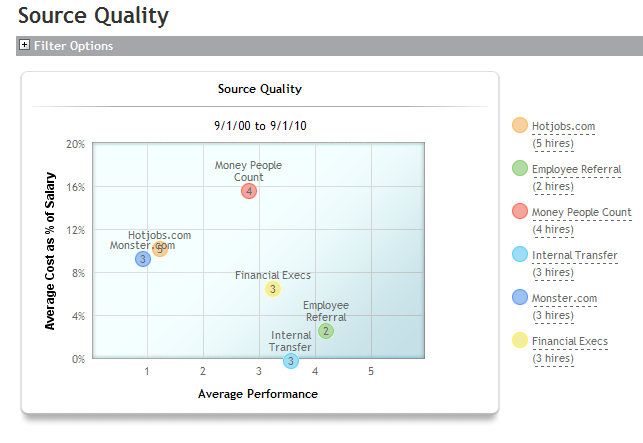

“To drive quality of hire, compare the employee’s first-year performance rating to their hiring source and the cost of hire,” says Carges. “It’s something every company can do to evaluate the effectiveness of the hiring source in delivering top performers and value.”

(See the example of hiring-source analysis provided by SuccessFactors.)

Managers frequently request candidates with previous industry experience because they believe it’s a predictor of on-the-job success. That hiring criteria often limits the sources recruiters can tap to find experienced prospects. A review of the employees’ actual performance ratings and the competencies possessed by top performers might be the first step in shifting the hiring paradigm, which in turn opens the door for new sources of hire.

Managers frequently request candidates with previous industry experience because they believe it’s a predictor of on-the-job success. That hiring criteria often limits the sources recruiters can tap to find experienced prospects. A review of the employees’ actual performance ratings and the competencies possessed by top performers might be the first step in shifting the hiring paradigm, which in turn opens the door for new sources of hire.

At R.L. Polk & Co., a review of the company’s top performers revealed that previous industry experience had little correlation to job performance, according to Jay Marshall, manager of talent acquisition. In fact, the requirement accelerated the cost of hire because candidates came from a boutique industry and often had to be enticed with higher salaries.

And at the same time, industry dynamics were changing, forcing employees into more business-facing roles that required different skills. As Marshall dug a bit deeper into what was really making employees successful, an entirely new profile began to emerge.

“When I looked at the behavior behind the performance, it was driven by teamwork,” says Marshall. “The bottom line is that it really altered what we were looking for, and now we look for team players with strong business acumen. That opened up many new candidate sources, and our average cost of hire has dropped $10,000 in the last 24 months.”

Today, Marshall says he no longer worries about how long it takes his team to hire new employees or how much a new hire costs, because by focusing on quality of hire, he has improved all the recruiting metrics at Polk.