Dice this morning became the second job board in a week to see its stock price drop after reporting a profitable quarter and a year of growth.

Dice this morning became the second job board in a week to see its stock price drop after reporting a profitable quarter and a year of growth.

Hours after the company reported it nearly doubled its fourth-quarter profit over the same quarter in 2010, meeting Wall Street’s expectations, its stock price took a 16 percent beating. In afternoon trading in New York, Dice Holdings was selling for $8.40 a share, down $1.59 on the day.

Last week Monster’s stock took a 20 percent hit after it missed analyst profit expectations and announced layoffs. The company earned 11 cents a share, rather than the 12 cents Wall Street expected. Yet, the company grew revenue for the year by about 14 percent and turned 2010’s loss into a 37 cents a share profit.

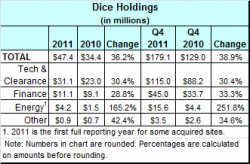

Dice, however, not only met the Street’s per share earnings prediction, but its $47.36 million in revenue was slightly ahead of what analysts expected. For the year, Dice reported revenue of $179.1 million versus $129 million in 2010. Profit for the full year was 49 cents a share. In 2010 it was 28 cents.

Those results did little to cushion the company’s 2012 prediction that revenues and earnings will come in below analyst expectations. For the current quarter, Dice says it expects revenue of $46 million and net income of $7.1 million. Analysts are looking for $46.83 million in revenue and per share earnings of 13 cents.

For the year, Dice is looking at revenue of $197 million. Wall Street wants $201.1 million.

In the announcement of the company’s financial results, Chairman, President, and CEO Scot Melland called 2011 “a terrific year for the company.” Calling 2012 “a more uncertain recruiting environment,” Melland said he expects the company to grow.

“Our strategic priorities are unchanged: expand the number of customers using our services, capitalize on the global opportunity in our energy vertical and serve more markets around the world.”