This article is co-written by Michael Cox, a program manager at Dr. John Sullivan & Associates.

The Big-Bet Recruiting Trends at the Top 10 Companies

It’s a dream of every recruiting executive to accurately predict the future direction of talent acquisition. Unfortunately, current recruiting-trends surveys (like LinkedIn’s annual Global Talent Trends report) can only reveal what the average firm is planning (because they are filled out by hundreds of average recruiters).

You don’t have to be a rocket scientist to realize that you would get a much more accurate and advanced picture of the future of TA if you knew the areas in which the top 10 elite companies (like Amazon, Salesforce, Facebook, and Alphabet) are currently making “big bet” investments.

If you knew their future direction, following their lead would make a lot of sense because these firms have such tremendous resources to invest in forecasting.You can safely assume that their directions will be more accurate than the assumptions made on your meager budget. In addition, knowing the TA investment areas of industry leaders will make it easier to remain competitive with them.

Fortunately, the authors of this article had the opportunity to survey the top 10 companies on LinkedIn’s Top Companies Where the US Wants to Work Now list.

Why the First Recruiting Big-Bets Survey of Elite Firms Was Created

After discovering the value of knowing where the vanguard of top firms was headed, we created what we eventually called “The Big Bets in Recruiting Survey” because it revealed the talent acquisition areas where the top firms were investing.

The survey went further and also revealed in which investment areas the top firms expected to have the highest business impacts. The key to getting an amazing 90% participation rate was promising each of the firms that their individual results would be kept anonymous. Knowing what the other top 10 firms were planning allowed individual firms in the group to understand where they stood compared to other elite companies.

A Snapshot Picture of the Results

The survey of the top ten elite firms revealed that at least one of the firms was investing in the following 10 areas. The big-bet investment areas listed below are ranked in descending order, with those with the highest expected business impacts appearing first.

- Shifting to data-driven recruiting

- Business-impact recruiting

- The application of AI/machine learning

- Other technology applications beyond AI

- Pipeline continuous recruiting

- Targeted and diversity hiring

- Recruitment marketing

- Collaborative recruiting

- Competitive-advantage employer branding

- Flexible/fluid workforce

Big-Bets Areas That Received at Least One No. 1 Ranking

- Data-Driven. It received the No. 1 rank from three different firms.

- AI/Machine Learning. It received the No. 1 rank from two different firms.

- Business-Impact Recruiting, Collaborative Recruiting, Recruitment Marketing, and Pipeline Continuous Recruiting. All received a No. 1 ranking from a single firm.

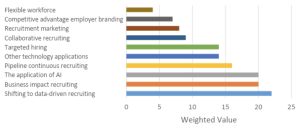

The Weighted Votes in Each Big-Bet Area

This chart reveals the weighted votes (based on likely business impact) that were received by each of the big-bet areas:

Action Steps for Each of the Top 5 Ranked Big Bets

This section contains some recommended action steps for each of the top-five ranked big bets. It also covers some existing best practices.

Big Bet No. 1: Shifting to Data-Driven Recruiting

TA decisions are based on data and analytics that reveal what actions improve quality of hire and business results. Data focus areas generally include the best source, job matching, the impact of slow hiring, predictive hiring criteria, and factors that attract and sell top candidates.

Note: The Business Impact Recruiting factor received a 25% higher total rating than the No. 2 big bet. Also, one top firm in this group has already made the transition to being data-driven. So, the score for this area would actually be higher if that firm had assigned a weight to this factor.

Data-related Action Items to Consider

- Commit to making all major TA decisions based on data.

- Measure new-hire performance, retention rates, and failure rates (quality of hire), and then identify the factors that correlate with them.

- Calculate the “recruiting batting average” for each hiring manager and recruiter.

- Project the likely internal career trajectory of new hires.

- Predictive metrics are growing in use and importance.

- The quality of applicants presented to hiring managers (percentage of qualifications met) should be a sourcing metric.

- The quality of candidates that were not hired can tell you if you are carelessly losing top applicants due to slow hiring or a bad candidate experience.

- The best firms continually experiment and test hypotheses related to recruiting.

- Be aware that recruiting technology and AI can’t operate without sufficient data and, in most cases, quality-of-hire data.

Best Practices in Data-Driven Recruiting

- One of the top five firms revealed that it is already building an in-house talent intelligence and research team.

- Test hypotheses with your talent analytics team to see what works, what doesn’t, and find new ways to improve your recruiting process.

- Another top firm reports that it is now focusing on the “external” side of recruiting data, like “market availability” and “talent availability” data.

- Improve data delivery so that recruiters, managers, and executives take action.

- Independent of the survey, in our experience, we have found Google, Sodexo, and Amazon to be the benchmark firms in the use of data.

Big Bet No. 2: Business-Impact Recruiting

Focus recruiting resources so that they produce the maximum measurable direct impact on strategic business goals.

Business Impact-Related Action Items to Consider

- Don’t be satisfied with simply aligning with business goals, When possible, directly impact them.

- Work with the offices of the CFO and the COO to ensure the accurate and credible measurement of recruiting’s business impacts.

- Start your business-impact measurement with already-measured and quantified jobs like sales, customer service, business development, and collections.

- Focus on revenue-generating or revenue-impact and innovation jobs. And when possible, convert TA results to their revenue impacts, because increasing revenue has the highest impact on executives (i.e., each 10% better-performing new-hire salesperson adds $220,000 in revenue per year).

- Prioritize and focus recruiting resources on high-margin, high-growth business-unit teams.

Big Bet No. 3: The Application of AI/Machine Learning

A focus on the utilization of AI/machine learning (and to a lesser extent, AI) for improving processes in recruitment messaging, sourcing, screening, candidate assessment, and candidate selling.

AI-Related Action Items to Consider

- Start with the assumption that in a fast-changing world, most of your recruiting processes and tools will soon become obsolete. Use machine learning for process assessment and continuous improvement.

- Without baseline performance of new-hire data (quality of hire), machine-learning can’t actually learn.

- One top-three firm says AI and machine-learning hype is everywhere, so be cynical about what vendors say and promise.

- TA areas that are likely to be impacted by machine learning:

- Identifying attraction factors

- Effective sourcing channels

- Better job matching

- Refining selection criteria

- More compelling offers

- Unconscious biases (redactions)

- Best communications channels

- Best time to hire/low competition

- Resume screening

- Best interview questions

- Recruiting funnel problem points

- Quality of hire

Big Bet No. 4: Other Technology Applications Beyond AI

TA must become more effective and efficient by widely applying other technologies, including chatbots, automated interviews, video interviews, virtual-reality assessments, CRM, blockchain applications, and automated recruiting processes.

Other Technology Application Action Items to Consider

- Remote Video Interviews. Increase interview availability, reduce candidate dropouts, and shorten time-to-fill by fully utilizing a range of video interviews. Automated interviews can be done in advance and they are a major timesaver.

- Interview Self-Scheduling. Use technology to reduce this top time delay in order to increase your hiring speed.

- Chatbots. Can provide answers 24/7 in order to keep candidates fully engaged (U.S. Army is the benchmark firm).

- Job Matching. Develop an algorithm for the more accurate placement of highly qualified applicants in jobs that are not initially obvious.

- Phone App. A full-cycle self-service recruiting smartphone app for managers is coming.

- Automated Assessment. Automated online and virtual-assessment to increase the accuracy and efficiency of soft and technical skills assessment.

Big Bet No. 5: Pipeline Continuous Recruiting

Continually build a talent pool of the people who are already attracted to your firm for future openings to provide more time for building relationships, assessment, and to avoid rushed sourcing, which impacts candidate quality.

Talent Pipeline-Related Action Items to Consider

- Online Talent Communities. Stretching out the hiring timeframe gives you more time to build relationships and to assess and sell tough candidates. Having an already-assessed and sold talent pool for key jobs reduces the need for “panic sourcing.” Nestlé Purina is the benchmark for filling jobs before they actually become open (talent pipeline case 43%).

- Corporate Alumni Group. Maintaining continuing relationships with your best former employees can result in both business and recruiting referrals. Top corporate alumni should also be targeted for boomerang rehiring (Da Vida is the benchmark firm here).

Big-Bet Directions for Those With Limited Resources

Obviously, many of the big-bet options are extremely expensive to execute, so if you’re looking for the lowest cost big-bet areas to invest in, here are some recommendations (the cheapest to implement listed first).

- Business-impact recruiting

- Collaborative recruiting

- Shifting to data-driven recruiting

- Recruitment marketing

- Fluid/flexible workforce

Final Thoughts

Technology is accelerating individual recruiter effectiveness. There is no doubt how AI/machine learning will shape the future; however, the next eighteen months will be dominated by data-driven decisions and business impact. These investments will separate average and elite recruiting departments by finding new, and better, ways to source, assess, and offer candidates.

It makes sense for recruiting leaders to take advantage of this once-in-a-career opportunity to know what the elite firms are actually investing in. It allows individual firms to develop a plan for minimizing the gap between your recruiting focus areas and those at their top talent competitors. Even if you’re just an ordinary recruiter who doesn’t like surprises, the results allow you to quickly see what’s on the horizon in our rapidly changing field.

If this article stimulated your thinking and provided you with actionable tips, please take a minute to follow and/or connect with Dr. Sullivan on LinkedIn and subscribe to ERE Recruiting Daily.