In the past few years, especially since Covid-19, we’re always asked at the end of the year what the recruiting and candidate experience trends are going to be in the new year. The reality is that we’re always hesitant to answer that question; most of us in the business of recruiting and hiring didn’t predict the pandemic in 2020 that dramatically changed our personal and professional lives forever. Nor did we predict all the economic volatility since and all the fallout.

We went from stable growth to super-high inflation; from massive layoffs to hiring freezes; from talent hoarding in tech to mass layoffs in tech and beyond; from extreme redeployment to extensive recruiter layoffs; and from HR and talent acquisition leader burnout to people leaving our profession altogether.

So, when asked again at the end of 2023 what we think the recruiting and candidate experience trends are going to be in 2024, the only answer we’re comfortable giving is this:

Candidate expectations across the candidate journey (pre-application to onboarding) will seemingly continue to increase, although year after year, most candidates simply desire timely acknowledgement and closure.

Unfortunately many employers big and small across industries will continue to marginally deliver recruiting and hiring experiences around the world. Ultimately, this will continue to drive candidate resentment — the percentage of candidates who will no longer be willing to apply again, refer others, have any brand affinity, or make purchases from a company that’s consumer-based.

That’s it. We hope we’re wrong, but our past and current CandE Benchmark Research tells us otherwise. We feel like employers have lost their North Star of improving and sustaining a quality candidate experience.

The Recruiting Focus Fluctuation

We’ve also learned over the years that staying fixed on that North Star isn’t easy, not with all the different business impacts that occur year after year. It’s a very small universe of companies that have been able to do it. The irony is that for many years now we’ve asked employers directly what their recruiting focus and priorities will be for the coming year.

And what has that main priority been over the years? Candidate experience.

The problem with asking them to predict what their recruiting focus will be in the coming year, continuing our theme of not wanting to predict what will happen because the world of work changes so rapidly, is the fact that what may be a priority today may not be a priority tomorrow, even if there are constants, like candidate experience.

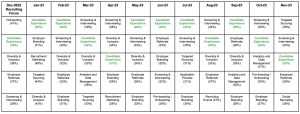

We’ve also been asking employers this year about what their priorities are month to month in our CandE Pulse surveys, and one of the constants that we’ve seen in the top five priorities is that “candidate experience” has been No. 1 and No. 2 for nearly the entire year, except in November, and even then it’s still at No. 3.

Ironic considering how much candidate experience ratings have plummeted this year. Granted, the past year has been economically volatile with recruiting teams getting leaner and candidate applications increasing, but as of the latest November Labor Department report, nearly 200,000 jobs were added. Plus, the unemployment rate dropped to 3.7%. The economic soft landing that many economists said probably wouldn’t happen just might still.

Besides candidate experience, you can see what the other CandE Pulse priorities have been through November 2023 and how they have varied month to month this year.

Top 5 Recruiting Priorities

When you review what comes and goes from the list — pre-boarding/onboarding, diversity & inclusion, application process, social recruiting, etc. — it’s clear that priorities can change. A lot. There are so many competing priorities that are fleeting like periodic meteor showers. Here’s the complete list of priorities employers choose from month after month:

- Analytics and Data Management

- Application Process

- Candidate Experience

- Career Site Development

- Current Technology Stack Optimization

- Diversity and Inclusion

- Employee Referrals

- Employer Branding

- Internal Mobility/Retention

- New Technology Implementation

- Pre-Boarding/Onboarding

- Recruiting Events

- Recruitment Marketing

- Screening and Interviewing

- Social Recruiting

- Targeted Sourcing

Our CandE Pulse survey respondents represent over 100 employers each month, with an average of nearly 50% of respondents that were from employers 2,500-100,000+ in employee size, and across many industries including technology, healthcare, education, government (public sector), nonprofit, manufacturing, finance and insurance, services, and many others.

In addition to asking what employers’ priorities are month after month, we also ask them how they are going to get all the work done.

Top 5 Ways to Get It All Done

Out of the top five each month, the most regularly recurring one is “improving processes.” This makes sense since it is where companies should tackle priority improvement and implementation first and foremost. The next regularly recurring activity is “candidate/employee experience survey feedback.

Here’s the complete list of ways employers are getting it all done:

- Candidate and/or Employee Survey Feedback

- Current Staffing

- Current Technologies

- Flexible Work Schedules (remote/hybrid)

- Improving Recruiting Processes

- More Staffing

- New Leadership

- New TechnologiesOutsourcing (individual consultants and/or consulting firms)

- Outsourcing (recruitment process outsourcing)

- Outsourcing (staffing agencies)

Besides the incongruence of lower candidate experience ratings this year and candidate experience being an ongoing priority, the good news is that throughout the past year of conducting CandE Pulse surveys, responding employers have said they’ve been hiring.

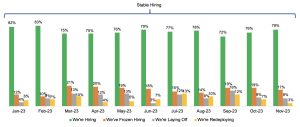

Hiring Status

The percentages have been consistently in the 70s to low 80s. Granted, the mix of employers responding vary each month, but seeing stable hiring month after month is promising. However, we have seen regular monthly fluctuations in those freezing hiring, laying, and redeploying.

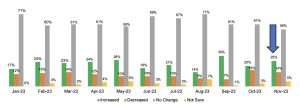

We also ask employers each month whether they’ve increased or decreased the size of their recruiting team this month. While this number decreased significantly during the summer months, it’s now up again to 25%.

Increased or Decreased Recruiting Team Size

We also ask each month about the job requisition load, and the monthly average has gone from 77% stating they manage up to 30 reqs each per recruiter in January 2023, to 59% managing up to 30 reqs each per recruiter in November 2023.

Those carrying 31 to 50 reqs each is up significantly in November 2023 compared to the rest of the year. Of course, while we want to assume this could be one factor as a sign of hiring growth, we understand that req loads always vary by job type, industry, and employer size, and again the fact that many recruiting teams are stable but leaner these days (unless they’re rebounding again based on what our CandE Pulse revealed above).

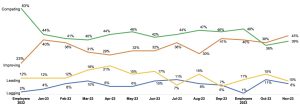

And as we do each year in our benchmark research, and now monthly in our CandE Pulse surveys, we again highlight how employers self-rate their own recruiting and candidate experience and whether or not their leading, competing, improving, or lagging.

Self-Rating Recruiting and Candidate Experience

When we compare the 2022 benchmark self-ratings to 2023 (we ask participating benchmark employers the same question each year), those companies that felt like they were competing and improving were much closer together in this year’s benchmark than last (48% and 40% respectively compared to 63% and 23%).

Otherwise, it was similar for those who said improving and lagging was where they were at. When we look month by month throughout 2023, there were consistent self-ratings with some fluctuations in July, August, and September.

The employers that respond to our CandE Pulse surveys each month vary, but we do know that no matter the mix, consistent recruiting and hiring while sustaining a quality candidate experience is difficult for most employers.

However, we’ve seen many multi-year CandE Award winners do it year after year (those employers that have above average ratings in our benchmark research, which ultimately is still a much smaller subset overall). We’ll cover the CandE Winner differentiators throughout our 2023 CandE Benchmark Research Reports once available in early 2024.

Will employers find their candidate experience North Star in 2024? Only time and our ongoing CandE research will tell.