It’s no secret to any of us that the appetite and shift to more direct sourcing is driven to a large extent by the focus on cost savings. Agency margins have been driven down to within an inch of their life over the years and so the next natural step was always going to be to “do it ourselves.” Internal recruiters have been around now for years, some under the guise of the RPO model.

It’s no secret to any of us that the appetite and shift to more direct sourcing is driven to a large extent by the focus on cost savings. Agency margins have been driven down to within an inch of their life over the years and so the next natural step was always going to be to “do it ourselves.” Internal recruiters have been around now for years, some under the guise of the RPO model.

Internal headhunters (I differentiate from internal “recruiters”), taking time to do full market mapping and cold call headhunting, are still very rare though. Mapping out competitors and building market intelligence takes time, and time is of course expensive. Whereas an internal recruiter may work on upwards of 100 vacancies per year (the numbers hugely fluctuate from company to company influenced by seniority of role, etc.), an internal headhunter doing the full lifecycle process may work on as little as 15 to 20 searches per year.

There’s also the issue of skillset required to do both roles. It’s very different asking a recruiter to sift through 100 resumes received in an inbox from a job posting than it is to ask a headhunter to start with a blank sheet of paper and map out the firm’s top six competitors and cold-headhunt call everyone at those firms who may have a relevant skillset. In my time spent heading up an executive search function at J.P Morgan, I never once posted a job advertisement. My role was purely to headhunt top talent in the market.

An internal headhunter is of course a role that should be used only for particular vacancies. It may be the most senior roles, or for niche roles, where typical channels to market aren’t satisfying the requirement.

So how do you convince the budget holders to invest in an internal headhunter who costs more than a typical internal recruiter, but who works on far fewer roles?

The easy answer is that it’s cheaper than an external headhunter, but that’s not where the true value lies. It all comes down to how important it is for a company to find the best candidates in the market, not just those on the market, and there is a big difference. On the market being candidates who are actively looking (active defined here as pursuing job ads with intent and giving recruiters permission to consider them for live vacancies) and candidates in the market are the whole of the rest of the working population. In my experience, candidates in the market are still open to a conversation about a potential career move despite not “looking.” You just have to call them and approach the call in the right way.

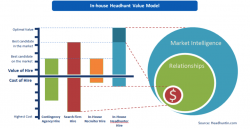

The chart above illustrates, in theory, the potential value of internal headhunting in relation to other candidate sourcing methods. It also introduces the relationship between the actual cost of the hire, with the potential value of the hire. If it’s confusing, try to take it all in at once, break it down, and look first at the bottom bar chart, cost of hire, then the top bar chart, and then follow it across to the conclusion on the right, the pie chart.

Cost of Hire

This model assumes that a contingency hire fee (meaning full payment to agency only if a hire is made through them) is 20% compared to a search firm’s fee which may be 30% (where a retainer may be paid and a lot more work goes into market mapping). These percentages can be quite different, but generally speaking there will also be a difference between search and contingent fees.

You’ll note the cost of hire to headhunt internally is showing as greater than the in-house recruiter advertising option. This factors in the staff cost and the time it takes to carry out a full market map search. An internal headhunter can spend weeks working on a particular role, whereas of course in-house recruiters can fill many roles per week. The actual cost per hire of direct sourcing, despite using no advertising cost, can actually work out to be more, although the potential return on investment is exponentially greater.

Value of Hire

This model is not prescriptive as recruiting is in itself an inexact science. The actual value of an in-house recruiter or contingency agency hire may well end up being optimal from time to time, but that would be more through luck, in comparison to a direct sourcing market map being carried out. Of course we can get lucky when great candidates are looking for work, but as an exclusive sourcing methodology, advertising and active candidate sourcing don’t stack up against headhunting in the true sense.

The optimal value refers to the “best candidate in the market versus the best candidate on the market” theory. When we map out the market and headhunt, our candidate pool is at its largest and we can assess whether we genuinely have the best candidate in the market at that time (because in theory we’ve spoken to all potential candidates in the market). The perceived value of the best candidate “on” the market cannot be credited with as much potential.

You’ll note that the search firm approach and direct sourcing both have the potential to identify the best candidate in the market (because both methods use competitor mapping to identify all potential candidates, and then contact them). Once again, this doesn’t represent the optimal value.

Hiring the best candidate in the market is our ultimate aim every time. However the difference between doing this through a search firm, and doing it internally through direct headhunting, is illustrated in the dark blue area at the top of the in-house direct hire bar.

When a search firm spends six weeks creating a short list to present their client with four candidates, they’ve spent that time in contact with the marketplace finding out a vast amount of information which helps them build their credibility and market insight. Some of that information makes it to the search report, but lots of it doesn’t. What certainly doesn’t make it to the search report are the relationships that get formed with key players in the market and rising talent. Both the market intelligence and relationships gained are represented here in the chart as additional value to the in-house headhunting model.

When headhunting directly, the in-house headhunter is building up rapport and relationships directly with the marketplace and getting direct market intelligence. This market intelligence may relate to the role you’re hiring for, or it may be useful information that the business can use to its advantage. It’s not just about the market intelligence on that particular search. It’s the contacts you make, and relationships you build that lead you to be able to pick up the phone next time on another search and ask an external candidate their opinion or for a referral. This is the real true value of internal headhunting. Over time, an internal headhunter builds on their market knowledge, gets close to the competition, and ultimately increases the probability of finding the best candidate in the market for every role, not just the best of who’s out there looking at the moment.