The employment outlook here at the start of 2013 is a lot like it was just last week at the end of 2012: cautious, slow, but with a few areas — high tech, for instance — where competition for talent will be even keener.

The employment outlook here at the start of 2013 is a lot like it was just last week at the end of 2012: cautious, slow, but with a few areas — high tech, for instance — where competition for talent will be even keener.

On the employee side, there’s a little less optimism now, with more workers than at any point during 2012 saying they don’t expect things to change much where they work in the next six months. As recently as the third quarter of last year, Glassdoor’s quarterly survey of workers found 48 percent of them expecting their company’s business performance to improve in the months ahead. Now, the fourth-quarter survey released this morning, says only 40 percent feel that way.

The findings of Glassdoor’s Employment Confidence Survey mirrors the monthly Consumer Confidence survey conducted by The Conference Board. The business organization’s much-watched Index declined by 6.4 points between November and December. While worries over the impact of the fiscal cliff accounted for a big part of the decline, The Conference Board said fewer consumers expect business conditions to improve in the next six months. In November 21.3 percent thought things would get better. In December only 17.6 percent said that, while those expecting business conditions to worsen increased to 21.5 percent from 15.8 percent.

Hiring managers and corporate HR leaders told CareerBuilder they expected more hiring in 2013, but the percentage of those saying that was 26 percent, only three points higher than a year ago, and only slightly outside the survey’s margin of error.

As CareerBuilder’s CEO Matt Ferguson observed, “Employers are still assessing the implications of a weakened global market and a modest recovery at home … We don’t expect 2013 to bring any big surprises in regard to employment; rather, it will continue on a path of stability and gradual growth barring any significant economic disruptions.”

On Friday, the U.S. Department of Labor will release its employment numbers for December. Bloomberg News said the average of a survey of economists put the number of new jobs at 150,000 for the month with no change in the 7.7 percent unemployment rate.

While the Glassdoor, CareerBuilder, and Conference Board surveys were all conducted under the shadow of the impending fiscal cliff, Congress’ last minute tax package isn’t expected to do much to change the outlook. The middle class tax rates may be unchanged up to the $400,000 (individual) level, but the Social Security payroll tax cut was allowed to expire. Workers will see a somewhat smaller take home in their first paycheck of the new year.

Even with the worst of the fiscal cliff’s impacts averted, “we’re probably going to see a slower economy in early 2013,” economist Guy Berger told Bloomberg. “Growth is going to be soft though not negative in the early part of the year, with the economy gradually picking up in the second half of the year.”

That’s what Glassdoor’s survey of workers found. Almost half of the workers in the survey expect their company’s outlook to be the same (neither better nor worse) in the next six months. Only 40 percent of workers expect a raise. A nearly equal number don’t, and 21 percent simply don’t know. Wage freezes could prove counterproductive, as salary considerations are the primary driver behind workers who start looking for a new job. Glassdoor’s survey found a third of workers saying they’re considering a job change in next year even if there’s no improvement in the economy. The primary motivator in accepting a new job — by 73 percent — is salary and comp. Second, by 55 percent, is location and length of commute.

“Now that it appears that the extreme highs and lows are behind us, the slow and conservative pace employees are seeing within their own employment situation is causing employees to evaluate if now is the time to see if the grass may be greener with another employer,” said Rusty Rueff, Glassdoor career and workplace expert.

“It is now more important than ever for companies to engage with employees to find out what will keep them satisfied, and strategize new ways to attract and retain their workforce, or face an impending growth in their turnover rate.”

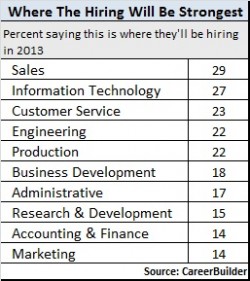

Not surprising then, that CareerBuilder says employers report their biggest pay increases will be for sales and IT, the two leading areas where hiring will occur this year. Based on a survey of 2,611 hiring managers and human resource professionals, CareerBuilder found 29 percent expect to add sales staff; 27 percent will add to their tech staffs; and, 23 percent will beef up customer service.

Not surprising then, that CareerBuilder says employers report their biggest pay increases will be for sales and IT, the two leading areas where hiring will occur this year. Based on a survey of 2,611 hiring managers and human resource professionals, CareerBuilder found 29 percent expect to add sales staff; 27 percent will add to their tech staffs; and, 23 percent will beef up customer service.

CareerBuilder also found 40 percent of employers plan to hire temporary and contract workers up from 36 percent last year. Among these employers, 42 percent plan to transition some temporary workers into full-time, permanent employees over the next 12 months.