It may seem like a strange proposition at first, but what if an experienced business executive who knew nothing about recruiting visited and took a snapshot assessment of your function?

It may seem like a strange proposition at first, but what if an experienced business executive who knew nothing about recruiting visited and took a snapshot assessment of your function?

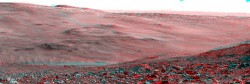

Obviously even a Martian executive would be able to quickly find and understand traditional recruiting functions like employer branding, sourcing, and interview processes. But what would they find missing? In other words, what standard business elements that exist in every other business function and process (like production, product development, supply chain, or marketing) would an outsider be surprised to find totally absent from your corporate recruiting function?

If you are a recruiting leader and one of your goals is to be “more businesslike,” you might be surprised at the number of common business process elements that simply can’t be found in corporate recruiting.

Business Process Elements That Are Almost Always Absent From Recruiting

If you were a strong business person who assessed the recruiting function, you might be surprised to find that many business process elements are simply missing. Those missing elements include:

Measures that we don’t bother to calculate in recruiting

- We don’t measure the failure rate of new hires — even though the failure rate of the hiring process has been reported to be as high as 46 percent, you won’t be able to find recruiting functions that define process output failure or no less measure it. The cost of hiring a failure (i.e. a new hire who severely underperforms, fails training, quits within a few months, or who must be encouraged to leave or be fired) may exceed the new hire’s yearly salary, so it’s critical that new hire failure percentages are tracked. Most business functions have learned to use sophisticated failure assessment measures like Six Sigma, but in recruiting we simply still complain that measuring quality is too complex to resolve.

- We also don’t calculate the new hire success rate (i.e. quality of hire based on new-hire performance on the job) — looking at the other side, even though measuring output success in business processes has also been common place since the 1990s, talent acquisition rarely measures the actual percentage of improvement in new-hire performance compared to last year’s hires.

- Even when we calculate quality of hire, we don’t use the information to improve recruiting — around 30 percent of firms actually measure their quality of hire but surprisingly almost no one (outside of Google) uses that new hire performance data in order to better identify the factors that predict new hire success on the job. Almost every other business function “validates” the components of their selection process and drops the ones that don’t predict success.

- We don’t calculate the ROI of the recruiting function — the ROI ratio (money returned compared to the money spent) is the most commonly calculated metric throughout the business. However, because recruiting does not quantify its business impacts (see item No. 4 above), recruiting leaders can only report the costs in isolation.

- We don’t quantify our overall business impact in dollars — every major business function calculates its overall yearly impact on key corporate goals like revenue, profit, customer satisfaction, and productivity. But once again recruiting routinely fails to put a dollar value on its results. Not quantifying its business impact is puzzling because very few actions in business have a higher business impact than hiring top performers and innovators into key jobs.

- We do not continually measure user satisfaction rates — every business function wants to satisfy its customers, whether they are internal or external. Unfortunately, it’s somewhat rare to find any corporate recruiting function that continually measures satisfaction with the hiring process among each group of its users (i.e. including prospects, applicants, candidates, new hires, and hiring managers).

- We provide only historical metrics and no predictive analytics — literally every metric in recruiting is historical, meaning that our metrics exclusively report what happened “last month or last year.” Other business functions have learned that in order to improve their decisions they need real-time metrics (that tell you what’s happening today). In order for recruiting to become forward-looking it must also develop predictive analytics in order to avoid surprises. These predictive metrics project trends and alert hiring managers and recruiters about what will likely happen in recruiting during the next six months.

- We don’t calculate the unintended hidden consequences of excessive cost cutting — most business leaders are experts in limiting budget cuts to their function. Many influence their business leaders by calculating the often partially hidden negative consequences that follow excessive cost cutting. For example, in recruiting, business executives may think they’re saving money when they, for example, cut the recruiting budget. But that cost-saving dissipates quickly if you show that the lower level of training that appear to have saved $10,000 actually resulted in the hiring of salespeople who sold $20,000 a month less. Talent acquisition is frequently forced to undergo cost cutting, but almost no one in the function seems to understand how to successfully demonstrate to a CFO the real total negative dollar consequences of hiring less-qualified recruiters, increasing req loads workloads, or increasing the use of low-cost but ineffective sources. I sometimes call these “other ledger costs” because the real costs do not appear in the same accounting ledger as the hidden consequences of the cost-cutting. Talent management leaders must work with finance and cost accounting to develop a process that can accurately find and predict the dollar costs down the road as a result of cutting resources in recruiting.

Common business actions that recruiting fails to take

- Most have not selected a recruiting strategy that fits their needs and goals — most recruiting organizations don’t even have a name for their corporate recruiting strategy. In fact, most don’t even know the names or the characteristics of the nearly 30 individual recruiting strategies that are available to choose from. And, no, a recruiting strategy named something meaningless like “we hire good people” doesn’t count.

- Most have no written recruiting strategic plan — even if recruiting leaders pick the correct recruiting strategy, the reality is that you can’t expect your team to be strategic and forward-looking without providing them with a written strategic plan. It is actually quite unusual in corporate recruiting to find a current, written, and distributed strategic plan (that goes beyond a simple PowerPoint presentation).

- We do not prioritize jobs so that we can focus hiring on the most important ones — business leaders in every function routinely prioritize their customers, products, and the tools that they use. Unfortunately, it is quite rare to find a recruiting function that prioritizes its jobs, prospects, and candidates, so that it can focus more budget and talent resources on hiring in those jobs that have the highest business impact. Treating all reqs equally turns out to be a huge business mistake.

- We don’t conduct a competitive analysis of our recruiting competitors — every business function that operates in a competitive external environment periodically analyzes its competitors. But it is a stretch to find a single corporate recruiting function that periodically conducts a side-by-side competitive analysis in order to determine if their recruiting tools and approaches provide their firm with a measurable and sustained competitive advantage.

- We do not routinely conduct failure analysis — with such a high new hire failure rate, we will have some major process failures. Unfortunately, few in recruiting take the time to conduct a “failure analysis” or “root cause analysis” every time recruiting experiences a major failure. Conducting periodic failure analysis allows recruiting to avoid repeating major errors again.

- We conduct no scheduled functional audit — almost every business function periodically schedules a comprehensive audit conducted by a neutral party. Unfortunately, few recruiting functions have conducted even one audit during the last five years. It’s a mistake for recruiting not to use these fresh eyes to find issues that most recruiters are simply too close to see.

- We do not apply lean principles to recruiting — lean practices and principles have spread to almost every aspect of the organization, with the exception of recruiting. Identifying value, increasing efficiency, reducing waste, and increasing flow are all principles that should be applied to recruiting.

- We have no talent pipeline or talent pool capability – almost everything in recruiting is unfortunately designed around an open requisition. However, other business functions do a lot of “pre-need” work, where they develop a pipeline or supply chain, so that they can instantly fill sudden needs. Because recruiting leaders can’t build an effective business case, they never have enough staff to implement and maintain a pipeline/talent pool recruiting process.

Final Thoughts

I challenge you to visit all of the other major business functions, (either on Earth or on Mars) and then ask their leaders if they routinely measure and do the 15 things listed here (including measuring failure rates, conducting audits, quantifying their business impacts, using lean principles, etc.) If you have the courage to inquire, don’t be surprised when you find that many of the process components and measures that are essential in other functions simply don’t exist or they only get lip service in recruiting.

Because so many other business functions already do them, it’s hard to argue that the numerous omissions presented here are hard to do, because so many others do them on a regular basis. We either simply don’t have enough “businesspeople” leading our recruiting functions, or leaders have little interest in being more “businesslike.”

photo of the Columbia Hills and Gusev Crater, Mars, from NASA/JPL/Cornell