My wife keeps threatening to move our retirement savings to dark web offshore accounts. Or to crypto. Or into tightly wrapped bundles tucked safely under our bed. Yikes.

The past few months have been quite the shock to the economic system. The Trump administration’s policies and tariffs are rattling markets at home and abroad. However fast and chaotic it’s all been, and if there is a silver lining to the madness, it now feels like most of us are moving in slow motion watching the spectacle like fireworks exploding in our hands.

And it didn’t help when I read that the majority of chief financial officers responding to the quarterly CNBC CFO Council Survey said that the economy will enter a recession in the second half of 2025. Also, 95% of CFO’s said The Trump administration’s policy approach is too chaotic, disruptive, and extreme for businesses to navigate effectively.

Then I read that The Conference Board’s expectations index, which measures consumers’ short-term outlook for the economy, dropped a marked 9.6 points to a reading of 65.2. That is well below the threshold of 80 that usually signals a recession ahead and the lowest level recorded in 12 years.

The lowest recorded in 12 years. Maybe I should just stop reading. Well, I read some more anyway. According to Nancy Vanden Houten from a recent Reuters article, lead U.S. economist at Oxford Economics, “The data continue to tell a story of relatively few private-sector layoffs but limited employment opportunities for those who are unemployed.”

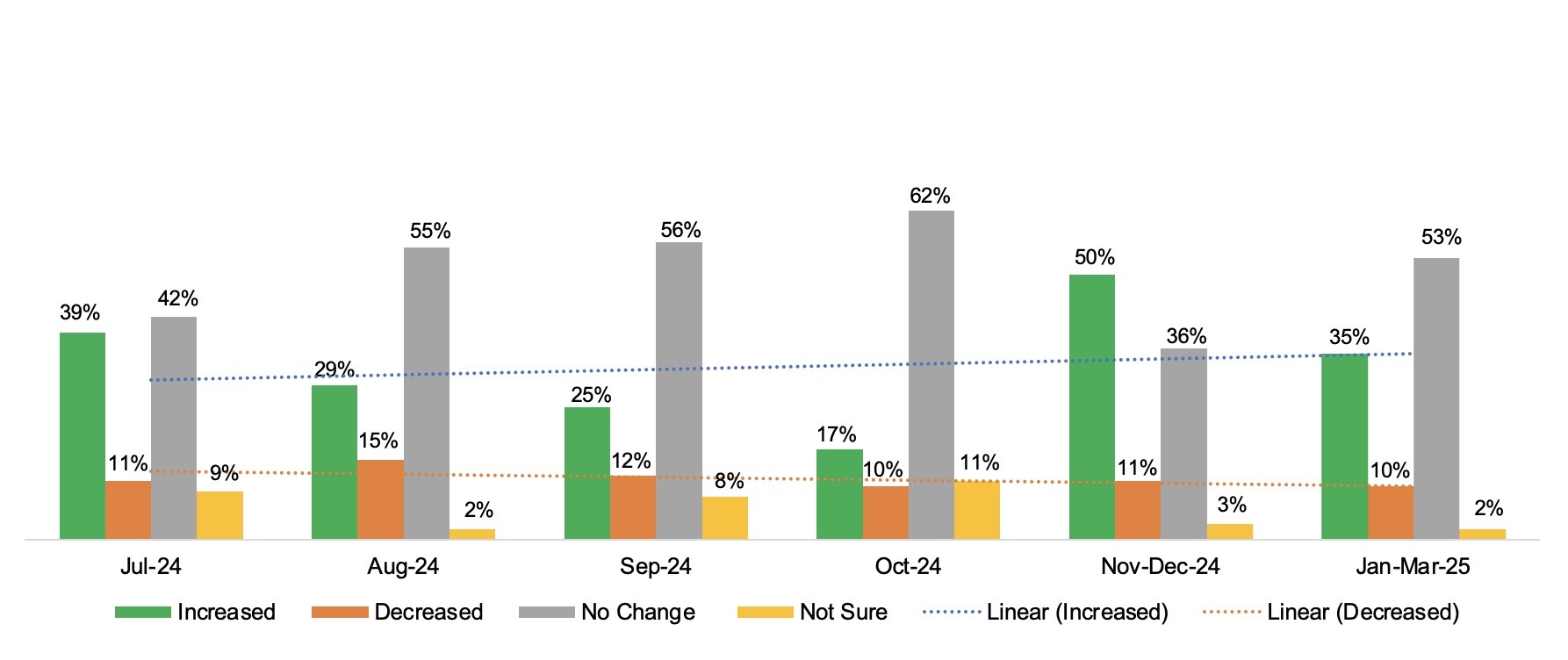

No one wants the prophecy of a soft economic landing to morph into a self-fulfilling one of crashing into the tarmac because of all the swirling darkness and dread. Some good news is that according to our latest quarterly CandE Pulse survey of over 220 responses from HR and TA leaders and recruiters (January-March 2025), recruiting budgets increased overall compared to last August-October (see figure below).

Recruiting Budget

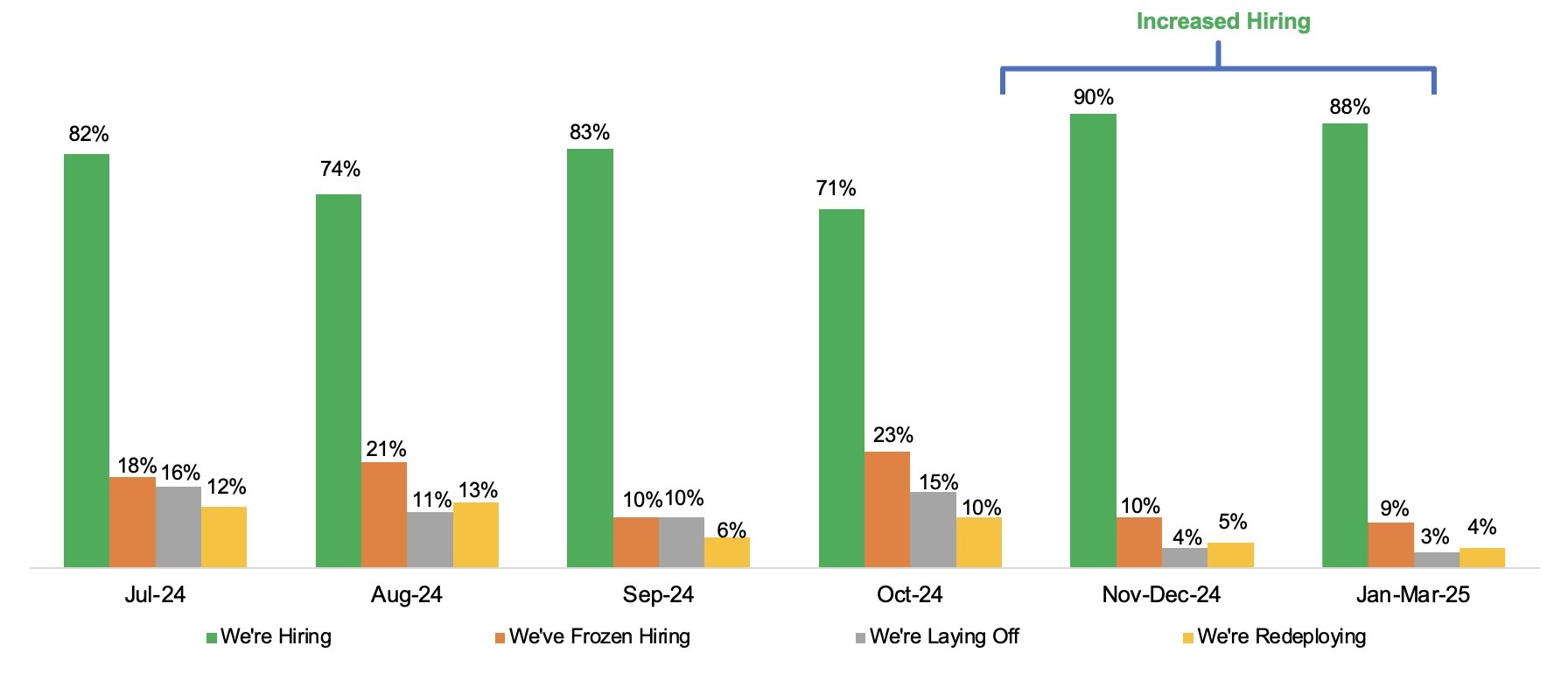

68% of the responses were from companies of 500+ in employee size and from industries like Healthcare, Manufacturing, Consumer Goods, Education, Finance & Insurance, Government (public sector), Hospitality, and many others. In the past five months, 90% of respondents to our Pulse survey also said they’re hiring (see figure below).

CandE Pulse Hiring Status

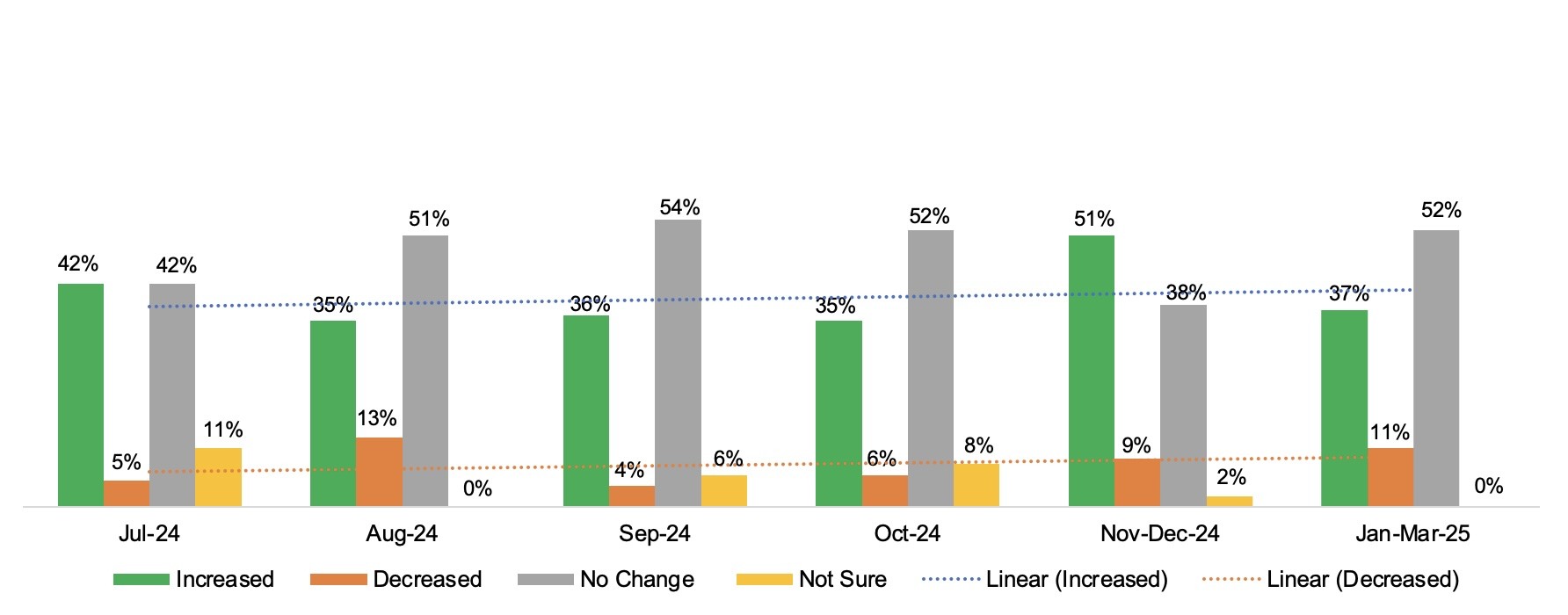

Recruiting team size continued to trend upward, although it decreased from our Nov-Dec 2024 CandE Pulse survey (see figure below). We hope this is a trend in investing in recruiting again as 2025 presses on, but we’ll have to wait and see what happens in Q2 and beyond.

Recruiting Team Size

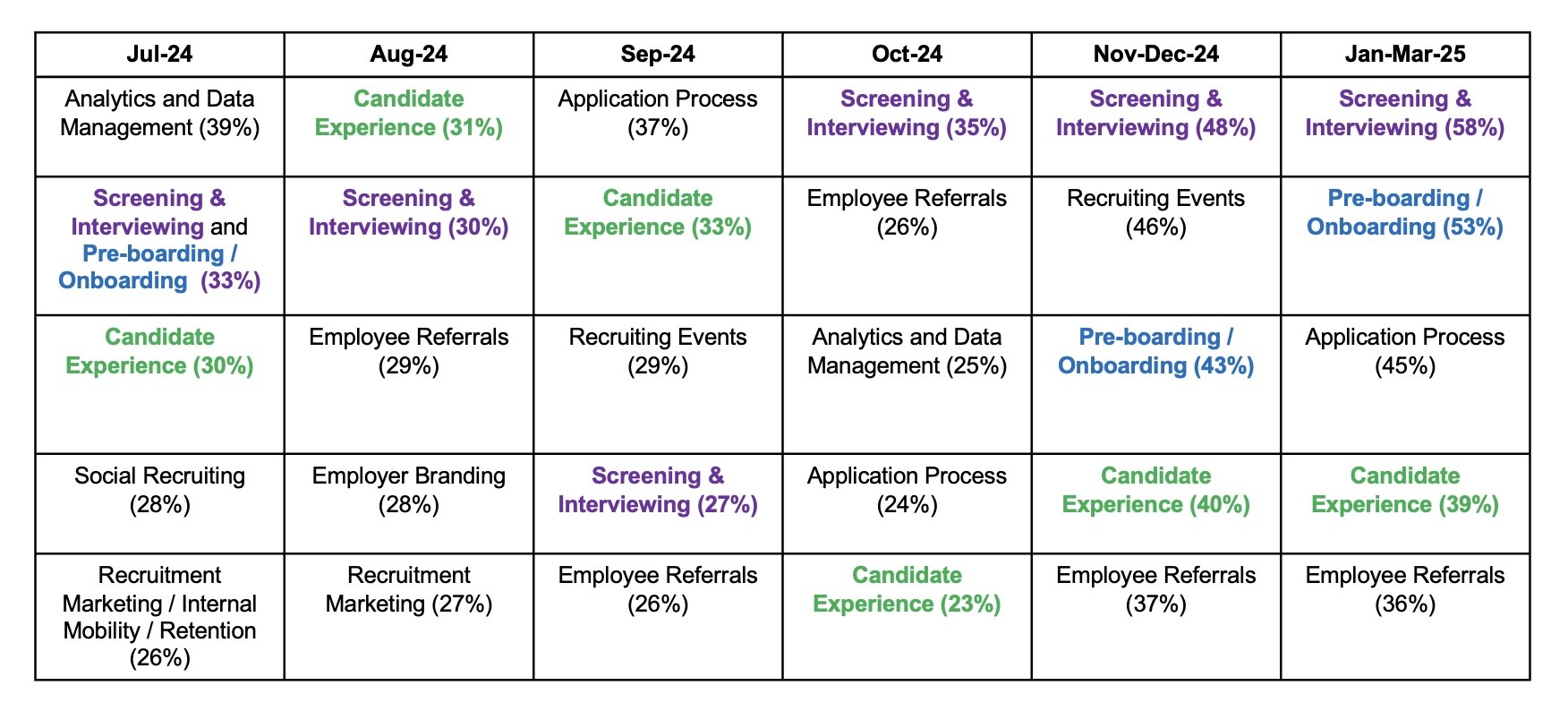

So, what were the latest recruiting priorities this time round? This is something we’ve asked our CandE Community and beyond with our CandE Pulse surveys since January 2023. Screening and interviewing – always a pivotal stage in recruiting and candidate experience – has been at #1 since last October (see table below).

This is again most likely due to increases in unqualified candidates applying, putting even more pressure on recruiters to vet candidates for the hiring managers to interview. It’s also the stage where there’s more investment from candidates, recruiters, and hiring managers alike – a greater level of human interaction that can make or break hiring decisions and overall candidate experience.

The application process came in at #3, which per what I stated above, isn’t a surprise. I also believe that more companies are working on optimizing their recruiting tech stacks, with or without AI, especially at the point of application due to the increased volume they’re receiving.

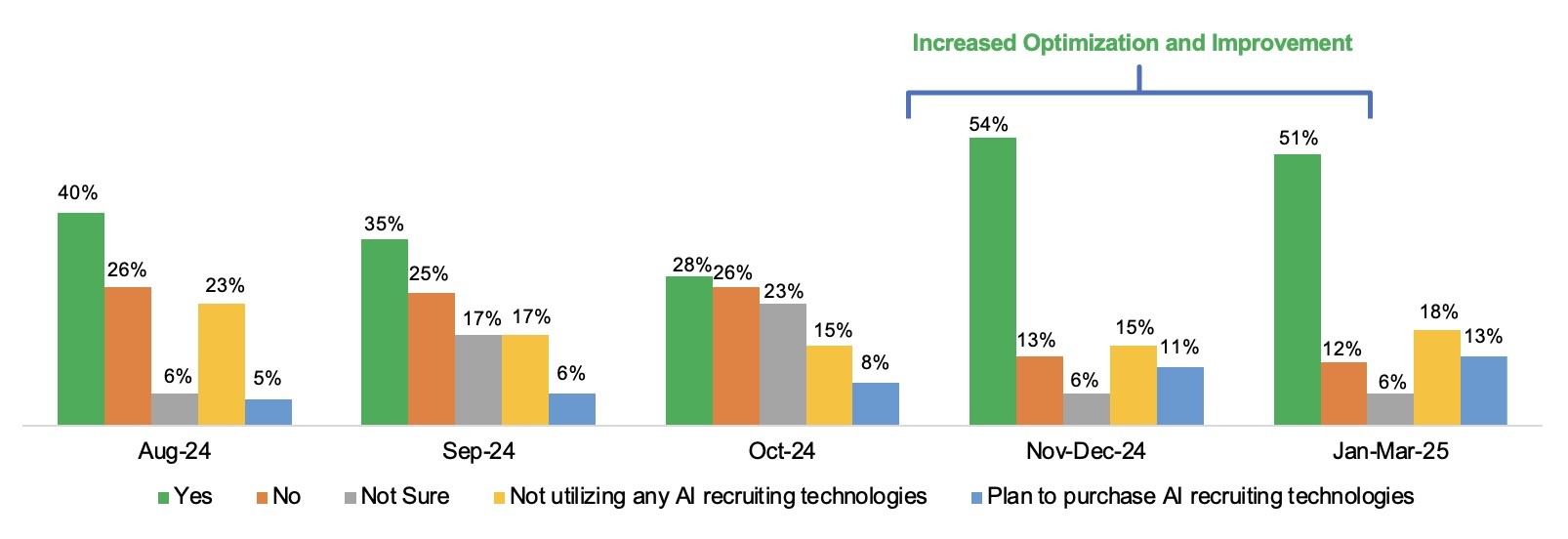

In fact, a newer question we’ve asked respondents in our Pulse surveys is whether or not recruiting technologies with artificial intelligence (AI) helped them to optimize and improve their recruiting and hiring efforts (for example, sourcing, screening, candidate communications, interview scheduling, etc.), this time a lot more said yes (see figure below).

AI Recruiting Technologies Helping Optimize and Improve Recruiting and Hiring

Pre-boarding and onboarding came in at #2 (the most important stage after interviewing). Candidate experience came in again at #4 this time, and is the only other top five priority this year and last along with screening and interviewing. Lastly at #5 were referrals again, something that employers depend on and that candidate experience can impact positively and negatively. Interestingly, early returns in our CandE Benchmark Research indicate that the percentage of candidates across job types who are extremely likely to refer is the same as last year (so far) – 26%.

As always, this is only the partial list of what we ask, and it’s clear that priorities can and do change. Granted, it’s a different mix of employers responding to these surveys each month, but still a sample set of what the priorities currently are.

Top 5 Recruiting and Hiring Priorities

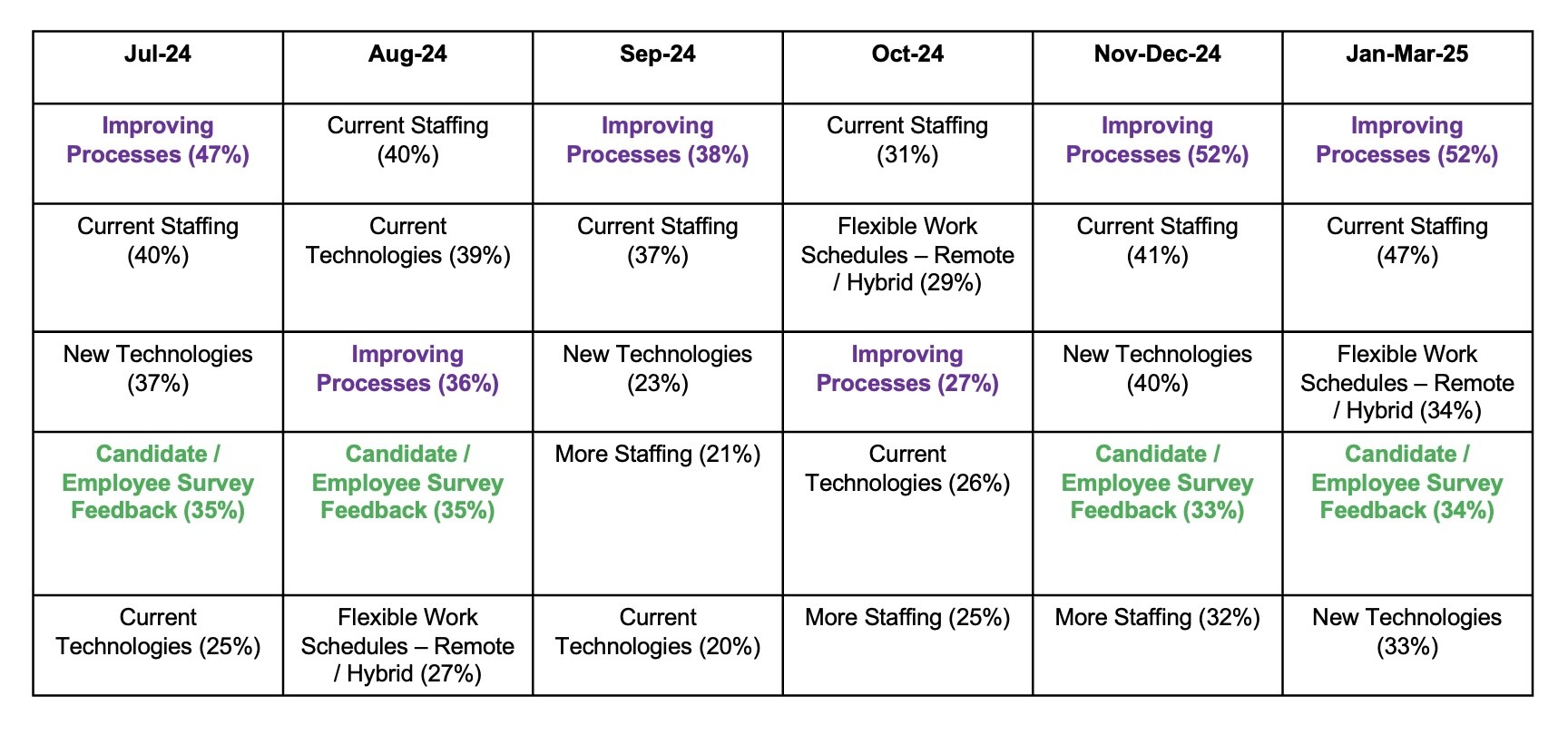

In addition to asking what employers’ priorities are month after month, we also ask them how they are going to get all their work priorities done. Out of the top five each month, the most regularly recurring one at #1 was usually “Improving Processes” (58% this time). Current staffing was at #2 this time, and Flexible Work Schedules – Remote / Hybrid was at #3. In a world of return-to-work mandates, flexibility is still a way to recruit and retain. Candidate and employee survey was again in the top five at #4, and new technologies was at #5 (see figure below).

Top 5 Ways to Get It All Done

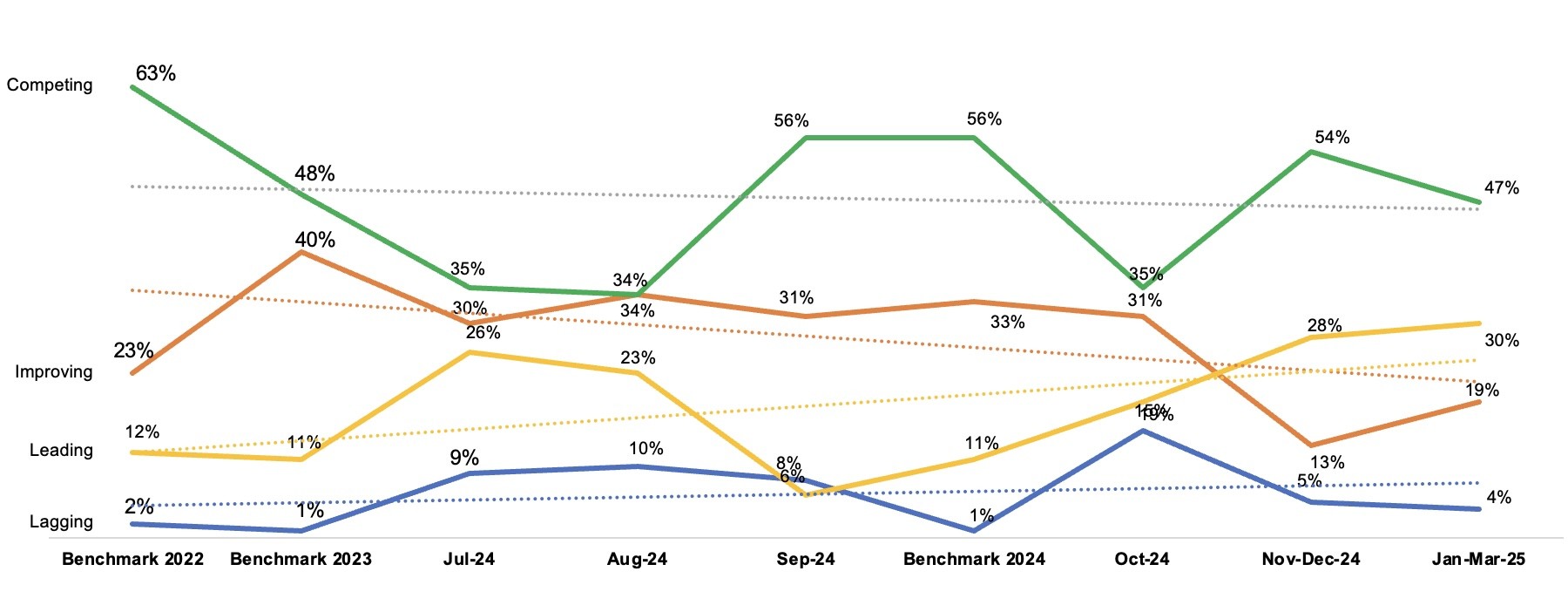

As we do each year in our benchmark research, and in our CandE Pulse surveys, we again highlight how employers self-rate their own recruiting and candidate experience and whether or not their leading, competing, improving, or lagging. Will those who said they were competing or improving, the usually biggest segment of responses, continue to decrease?

The trend lines continue to be clear – since our 2022 Benchmark, “competing” continues to slide slowly downward, although it was still on the higher side this quarter (see figure below). I’m surprised the market forces around us haven’t quelled more of the competitive confidence. But it has impacted Improving, although that’s up again this time around. These are always the two biggest segments in this indicator. Lagging also decreased slightly while leading has increased significantly.

Each month these are self-reported ratings and are subjective, and they are also a different mix of employers each month, but we definitely prefer employer confidence in competing, improving, and leading to remain stable or increase. Of course, there’s constant volatility and business impacts, and the proof is always in the candidate experience ratings themselves.

Self-Rating Recruiting and Candidate Experience

Economic darkness and despair abounds, but it does feel like there’s more market resilience shining through here and there. At least for now. If we can keep consumer confidence from crashing further, along with our retirement accounts, and government economic policies normalize (we can hope), and employers get back to growing and hiring at a steady pace, then maybe we can create a self-fulfilling soft landing.

Maybe.