The private sector created 176,000 jobs in June, says a report this morning from payroll processor ADP, surprising economists who were expecting far fewer — closer to 108,000 — and raising the possibility the U.S. may avert a third summer hiring slump.

ADP’s National Employment Report, is considered a harbinger of the official government report, which is scheduled to be released by the U.S. Department of Labor Friday morning. Economists are expecting that report to show the economy created between 90,000 and 100,000 new jobs last month. The 8.2 percent national unemployment rate is forecast to remain unchanged.

Now, says Joel Prakken, chairman of Macroeconomic Advisers, LLC, ADP’s partner in the report, “The gain in private employment is strong enough to suggest that the national unemployment rate may have declined in June. Today?s estimate, if reinforced by a comparable reading on

employment from the Bureau of Labor Statistics tomorrow, likely will ease concerns that the economy is heading into a downturn.”

The ADP report showed small employers — those with fewer than 50 workers — accounted for more than half the new jobs, adding 93,000 to their payrolls during June. Employers with 50 to 499 workers added 72,000 new jobs. Almost all the new jobs — 160,000 — were in the service sector. Manufacturing added 4,000.

The numbers are derived from ADP’s payroll processing data. The company has some half-million clients with a total payroll of more than 21 million workers. Government, whose payrolls are not handled by ADP, have been reducing their headcount for months. The official Labor Department report tomorrow is expected to reflect the continuing government cutbacks.

Although ADP’s numbers rarely synch with the government’s, they do tend to indicate a general direction, which in this case would mean tomorrow’s Labor Department report will be considerably stronger than the 69,000 new jobs reported for May. It may also beat the forecasts. Even if the official report comes in just where economists expect, it would be the largest jobs gains since the start of the Great Recession.

That would be a sharp turnaround from the last few years, when lower job numbers in May and June signaled a summer-long hiring slump that didn’t improve until the fourth quarter.

Today’s unemployment numbers offered hope that 2012 will be different. The Labor Department said there were 14,000 fewer new unemployment claims filed last week, the largest drop in the last two months. It brings the four-week average of seasonally adjusted new unemployment filings to 385,750.

“Jobless claims are a move in the right direction. The drop, combined with the ADP report earlier, suggests the jobs market is not as weak as recent data has suggested,” said Omer Esiner, chief market analyst at Commonwealth Foreign Exchange in Washington.

Meanwhile, outplacement specialists Challenger, Gray & Christmas, said planned corporate layoffs fell to their lowest level in over a year, coming in at 37,551 planned job cuts last month, down 39.3 percent from 61,887 in May, and down 9.4 percent from June last year.

Looking ahead toward the end of the year, CareerBulder’s mid-year jobs forecast suggests more employers expect to hire workers through the end of the year.

Looking ahead toward the end of the year, CareerBulder’s mid-year jobs forecast suggests more employers expect to hire workers through the end of the year.

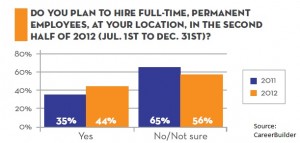

CareerBuilder’s survey of some 2,000 hiring managers and HR professionals found 44 percent of them plan to hire full-time, permanent staff from now through the end of the year. That’s an increase of 9 points over 35 percent who said that last year.

Part-time and contract hiring is also likely to increase, with 21 percent of the survey respondents saying they planned to increase headcount in both areas.

Companies with more than 499 employees are more likely to hire than are those with fewer than 50, 34 percent versus 21 percent. Tops on the list of positions are those in customer service, with 24 percent of employers reporting they plan to fill those positions first. Information technology was cited by 22 percent; sales positions by 21 percent, and; administration jobs by 16 percent.

CareerBuilder reported that its survey found 34 percent of the respondents added full-time, permanent headcount in the second quarter. In April, the company forecast 30 percent would add full-time, permanent staff; 6 percent weren’t sure of their plans.