Building diverse candidate pools and effectively timing outreach requires a strategic approach grounded in market data, industry trends / macro-headwinds, and demographic insights. This article outlines how talent acquisition teams can utilize open-source tools and leverage macroeconomic indicators to refine their sourcing strategies, identify diverse candidate pools, and effectively time their messaging. By leveraging these methods, TA teams can enhance their sourcing practices and create more inclusive workforces.

Identifying Diverse Geographic Markets (Where to look)

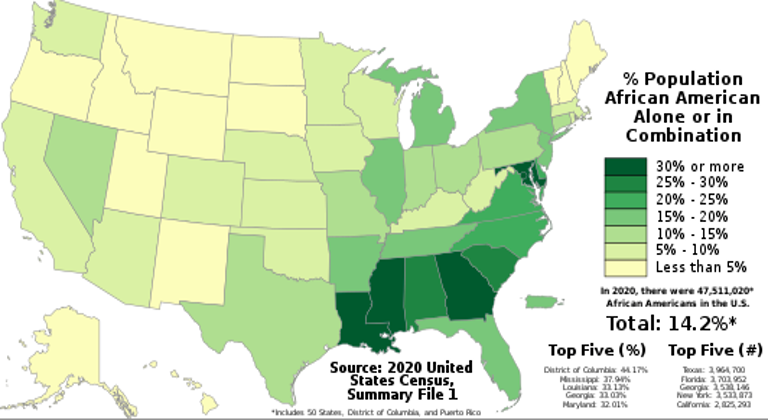

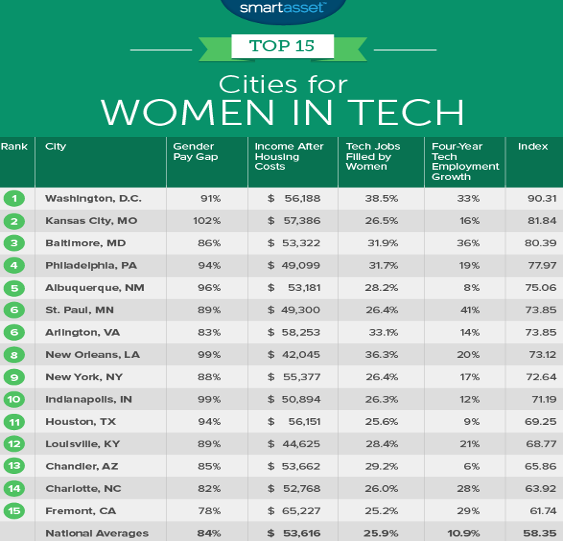

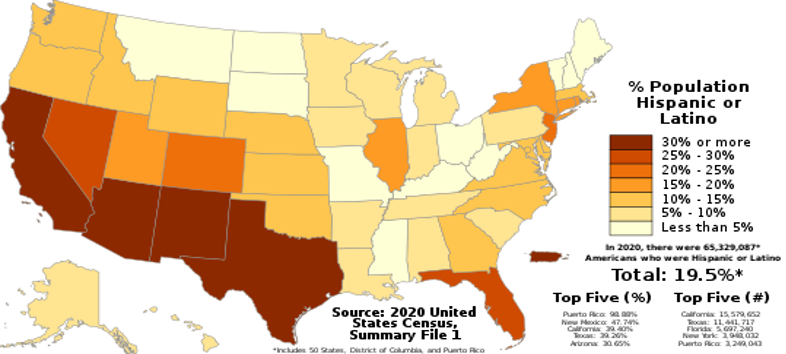

Open-source tools like Census Data, LinkedIn, and Google are extremely useful when targeting regions and companies. For example, when looking to improve the gender and/or race/ethnicity diversity within your technical talent pools, start by targeting specific cities and hubs:

- Regions with higher concentration of African American talent: Atlanta, Detroit, Houston, Baltimore/DC & Raleigh/Durham

- Regions with higher concentration of Female engineering talent: DC, Boston, Northern Virginia, NYC, Seattle, Charlotte & Philadelphia

- Regions with higher concentrations of Hispanic and/or LatinX talent: Miami, Phoenix, Austin, Tampa, Los Angeles & San Antonio

Once focused on diverse geographic regions, targeting companies that have diverse employee populations (reference lists from Google) will allow recruiters to improve the diversity of their candidate pools. Companies like Netflix, Microsoft, Google, Intel, are a good place to start.

The above information can be found through mining Google, leveraging existing lists and using tools like Chat GPT to develop additional lists.

By leveraging the above insights, recruiters can build targeted lists to focus their efforts effectively and successfully identify where to start their sourcing efforts.

Develop Target Individual /Company Lists per Geographic Region (who to target):

The development of target lists will allow recruiters to create and share reusable products (company & candidate) for current and future searches.

For instance, if you are searching for URM Product Management leaders, you are now aware (per census data and target lists) that you should target the Southeast, Southwest, and specific cities.

Additionally, if you layer pre-existing “top diverse tech company” lists from open-source sites on top of your geographic targeting, you now have your focus pool of candidates.

Timing Messaging with Macro Headwinds (When)

Tracking Economic Indicators

Now that recruiters know where and whom they are targeting, the remaining question is when is the best time to reach out to this candidate pool.

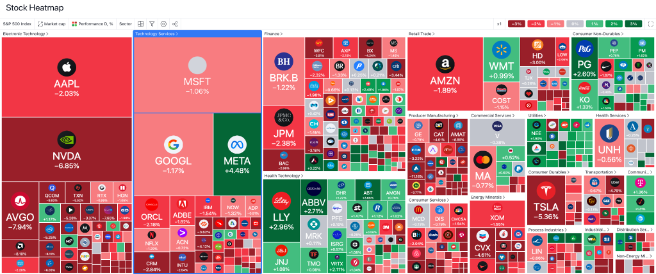

Economic trends significantly impact recruitment timing. Tools such as Robinhood, TradingView, FinViz, and a variety of open-source tools and news sources enhance recruiters’ ability to monitor stock performance, while resources like MarketWatch, Seeking Alpha & The Wall Street Journal provide insights into / context of macroeconomic shifts. The timing of outreach during periods of market churn / turbulence can open doors to candidates that are starting to consider new opportunities (stay ahead of the curve).

For example, see a snapshot below of TradingView (Stock market heatmap) below. This tool allows recruiters to review customizable stock market segments (i.e., Finance, Tech, Healthcare & Transportation) and their livestock prices.

Leveraging the above census data will provide recruiters with the ability to target highly diverse geographic market pools. Stacking the use of tools like TradingView will allow recruiters to leverage market information to time messaging in line with macroeconomic trends.

Macro trends to consider when timing your messaging outreach include:

- Company stability (stock price dip, C-Suite turnover, Short-sell positions, Activist Investors / Acquisition Target)

- Market position (is the company growing / leading or shrinking)

- Segment position (is the segment (i.e., Chips, Robotics, Crypto) growing or shrinking

Utilize Automated Notifications and build processes into daily routine (How)

Stay ahead of trends by setting up automated alerts for custom stock market tracking, current events and macroeconomic shifts. For instance, monitoring declines in stock prices or industry shifts can signal potential job market changes, allowing recruiters to time messages for maximum impact.

- Google Notifications (automate for specific current events and company news)

- Robinhood (set up alerts, review 52-week highs & lows, review daily price jumps / drops)

- FYI (review for recent layoffs)

- TradingView (set alerts for specific stocks / industries)

Example of this strategy in use:

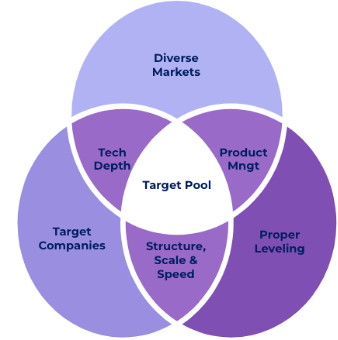

Per the image below, we are looking for candidates at the intersection of Diverse Geographies, Target Companies (level / bar / focus), depth & breadth meshed with a macroeconomic driver.

Sample Search: TA is looking for a VP of Product Management (remote work is allowed) and HR has flagged a lack of LatinX and African American representation within product management leadership.

Target locations:

- LatinX: Miami, Phoenix, Austin, Tampa, Los Angeles & San Antonio

- African American: Atlanta, Detroit, Houston, Baltimore/DC & Raleigh/Durham

Tech companies within target locations:

- Hispanic/LatinX:

- Miami (Microsoft, Apple, Oracle, Amazon, SAP, IBM & Magic Leap)

- Phoenix (Intel, GoDaddy, Carvana, Apple, Axway, Cognizant & PayPal)

- Austin (Dell, LogicMonitor, SailPoint, Amazon, Apple, Atlassian, Apple, Duo Security, Adobe, Google, AMD, Facebook & IBM)

- Tampa (JPMC, Citadel, Rapid7, Wise, Verkada, Procore, PwC & IBM)

- Los Angeles (Riot Games, Snap, GumGum, Google, Hulu, SpaceX & Disney Interactive)

- San Antonio (Rackspace, iHeartMedia, IBM, HEB, Oracle, Dell & Amazon)

- African American:

- Atlanta (Salesloft, MailChimp, Global Payments, Apple, Thoughtworks, Greenlight & Unity)

- Detroit (GM, Amazon, StockX, Dynatrace & Duo Security)

- Houston (BMC, Microsoft, HPE, PROS, Cardtronics & Infosys)

- DC / Baltimore: (Apple, Amazon, IBM, Google, Microsoft, Oracle & PwC)

- Raleigh / Durham (IBM, RedHat, Cisco, SAS, Amazon, Citrix & Epic Games)

- Macroeconomic Drivers (Impacting target companies):

- Stock declines

- RTO (return to office)

- Layoffs

- Patterns / Trends (Companies with large RTO push):

- RTO: Amazon, JPMC, Goldman Sachs, Disney, Walmart

Target Companies (RTO):

- Amazon

- Dell

- Apple

- Oracle

- SAP

- IBM

Target Companies (Macroeconomic Headwinds as of 1/3/25):

- Intel (Per Robinhood, stock is down 56% in the past year)

- Adobe (Per Robinhood, stock is down 25% in the past year)

- AMD (Per Robinhood, stock is down 8% in the past year)

- Rapid7 (Per Robinhood, stock is down 27% in the past year)

- Snap (Per Robinhood, stock is down 23% in the past year)

- iHeartMedia (Per Robinhood, stock is down 13% in the past year)

- Unity (Per Robinhood, stock is down 37% in the past year)

Sample Search String:

- Location: Miami, Phoenix, Austin, Tampa, LA, San Antonio, Atlanta, Detroit, Houston, DC, Baltimore, Raleigh & Durham

- Target Companies (within regions): Amazon, Dell, Apple, Oracle, SAP, IBM, Intel, Adobe, AMD, Rapid7, Snap, iHeartMedia & Unity.

- Large companies with RTO push (Amazon, JPMC, Goldman Sachs, Disney, Walmart)

- Title: (“VP” OR “Vice President” OR “Sr. Director” OR “Senior Director” OR “Director” OR “Head of”) AND (“Product Management”)

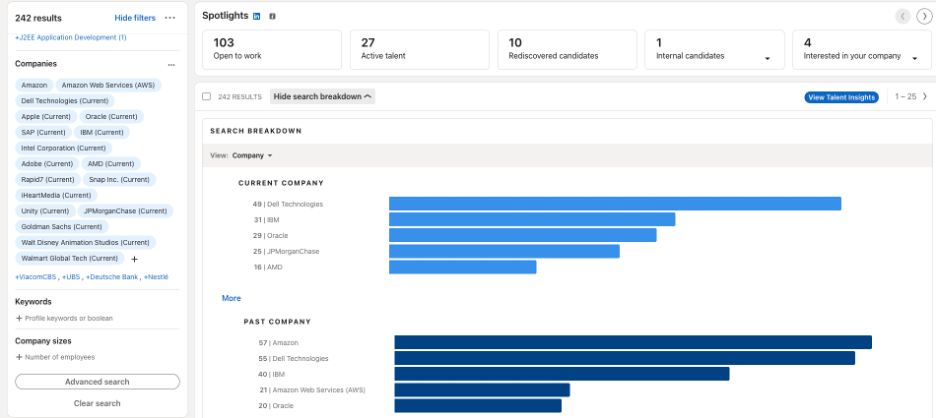

Results from LinkedIn Recruiter:

- 242 Profiles, 42.5% of profiles are actively “open to work”

- High representation of URM Candidates

Effective recruitment strategies rely on leveraging market data, identifying diverse markets, and aligning outreach with macroeconomic conditions. By utilizing the tools and techniques outlined in this article, organizations can build robust, diverse talent pools and enhance their overall sourcing processes.

In short, being market informed, and event driven will allow recruiters to focus sourcing efforts on target rich geographies and time outreach in line with macroeconomic factors.

(*This article represents my own views and sourcing approach & is not affiliated with my employer*)