You’ve heard that old saw that if something quacks like a duck, walks like a duck, it’s probably a duck? Might as well apply it to the U.S. economy.

You’ve heard that old saw that if something quacks like a duck, walks like a duck, it’s probably a duck? Might as well apply it to the U.S. economy.

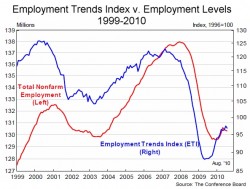

Today’s Economic Trends Index from The Conference Board declined slightly from July. It now stands at 96.7. In July it was 97.4.

Obviously, that’s not good news, though a .7 drop in an index that is up 9.4 percent in a year might be ignorable if all it did was quack. But the Index is also walking like the duck it is. For the first time since March 2009 seven of the eight components that go into the index turned negative.

The Conference Board reported the weakening indicators were: Percentage of Respondents Who Say They Find “Jobs Hard to Get”; Initial Claims for Unemployment Insurance, Percentage of Firms With Positions Not Able to Fill Right Now; Part-Time Workers for Economic Reasons; Job Openings; Industrial Production; and Real Manufacturing and Trade Sales.

The only component of the Economic Trends Index that improved between July and August was the number of employees hired by the temp industry. That’s a strong sign that America’s companies aren’t yet confident enough to hire full-time.

“Employment growth has been slow lately, and the Employment Trends Index suggests that it may slow even further this fall,” said Gad Levanon, associate director, Macroeconomic Research at The Conference Board. “However, we still expect job growth rather than an outright decline in the next several months.”

A Manpower survey also out today supports that view. The staffing firm’s quarterly survey of some 18,000 employers says 71 percent of the businesses don’t expect to hire or layoff any workers. Only 15 percent anticipate increasing staff in the 4th quarter; 11 percent expect to cut workers. The final 3% of employers are undecided about their hiring intentions.

A Manpower survey also out today supports that view. The staffing firm’s quarterly survey of some 18,000 employers says 71 percent of the businesses don’t expect to hire or layoff any workers. Only 15 percent anticipate increasing staff in the 4th quarter; 11 percent expect to cut workers. The final 3% of employers are undecided about their hiring intentions.

The Net Employment Outlook, often shortened to simply Outlook or NEO, is a +4 percent, or +5 percent when seasonally adjusted. That’s up from the -1 percent for the 4th quarter of 2009 and flat with the 3rd quarter Manpower forecast.

The forecast is just what a slew of surveys and indices predicted would be ahead for the second half of this year. In a survey reporting 65 percent of employers expected no change in staffing levels during the second half of 2010, CareerBuilder CEO Matt Ferguson said, “The survey indicates that we’ll see sustainable new job growth through the remainder of the year, but it will be absent of any dramatic shifts.”

Now, Manpower Inc. Chairman and CEO Jeff Joerres, is saying the same thing. “The hiring intentions for the fourth quarter are not enough to break through the labor market sound barrier that we’re all eagerly anticipating, as 71 percent of employers indicate no change in hiring.”