Did you hear that? Most talent acquisition leaders and their recruiting teams let out a collective sigh of relief that the joyless ride of 2023 was over. Even if it really wasn’t (or still isn’t, yet, even in early 2024, but we desperately want it to be).

Leaner teams, sub-optimized recruiting technologies, higher applicant volumes, increased candidate resentment, anemic net new hiring, and so much more — stuck in the gridlock of recruiting frustration. And we thought the pandemic was rough on recruiting.

Yes, there were more resilient industries like healthcare, retail, hospitality, and manufacturing that helped the monthly jobs reports in 2023, and December was no exception. We added 216,000 jobs, up from 173,000 the previous month. This surprised Wall Street (again) and economists. Plus, the unemployment rate stayed flat at 3.7%.

But for the majority of employers and industries around the world, the global economies, inflation, wars, continued political divisiveness, social inequities — all impacted recruiting and hiring ecosystems, as well as what was listed in the first paragraph above.

What we found in our 2023 CandE Benchmark Research (coming out very soon) was that employer expectations were definitely reset when it comes to their delivery of recruiting, hiring, and of course, the candidate experience.

Perception Gaps

While we don’t literally ask candidates or employers if their expectations are higher or lower, we can extrapolate that sentiment from some of our key ratings data. Pre-covid, the majority of employers around the world rated themselves higher than their candidates did across three of our key ratings: willingness to apply again, willingness to refer others, and willingness to change their relationship with an employer positively or negatively.

Each year we ask employers to self-assess across these three and then compare that against their candidate responses. We first noticed this trend in 2020 when employers hiring across regions rate themselves lower than their candidates on at least one of these three key data points.

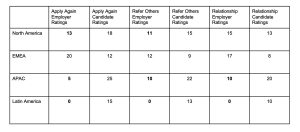

This trend continued and in 2023, most employers rated themselves lower than their candidates did in these key ratings, except for in EMEA. (In the table below, the bolded numbers are the lower employer ratings compared to their candidates).

Perception Gaps in North America, EMEA, APAC, and Latin America Key NPS Ratings

We call these differences perception gaps — how employers see their recruiting delivery versus how their candidates say they’re experiencing it. Again, because of all the disruption and volatility in recruiting and hiring over the past three years, we’ve found most employers have reset their own expectations lower than ever this year of how they recruit and hire while their candidates have most certainly not.

We also convert our key ratings to the Net Promoter Score (NPS) scale of +100 to -100. It’s interesting how glaring the negative perception gap in EMEA is compared to the other regions (which we’ll explore more in upcoming research reports).

Latest CandE Pulse: December 2023

But maybe after that collective sigh of relief and the reset of recruiting delivery and candidate expectations, there are signs of growth and stability in the road ahead, albeit a potentially bumpy one along the way.

There are employers that are working on improving their recruiting process and optimizing their technologies to meet the demands of the bumpy road ahead. Many of such companies participate in our annual CandE Benchmark Research Program.

For the past year, we’ve been been asking these employers and many others in our CandE Community about what their priorities are month to month in our CandE Pulse surveys, and one of the constants that we’ve seen in the top five priorities is that “candidate experience” has been No. 1 and No. 2 for nearly the entire year, except in November, and even then it was at No. 3.

Top 5 Recruiting and Hiring Priorities

You can’t close the candidates you really want to hire without improving your candidate experience. And to do that, you have to improve your recruiting processes, like the others that made up the top five in the December 2023 CandE Pulse survey results:

- Screening & Interviewing (44%)

- Candidate Experience (32%)

- Social Recruiting (31%)

- Application Process (31%)

- Diversity & Inclusion (28%)

And this is only the partial list of what we ask. When you review the perceptions-gap table earlier, it’s clear that priorities can change. A lot. Every single month. Granted, it’s a different mix of employers responding to these surveys each month, but still a sample set of what the focuses currently are.

Our CandE Pulse survey respondents represent over 100 employers each month, with an average of over 54% in December that were from employers 2,500-100,000+ in employee size, and across many industries.

In addition to asking what employers’ priorities are month after month, we also ask them how they are going to get all the work done.

Top 5 Ways to Get It All Done

Out of the top five each month, the most regularly recurring one is “Improving Processes.” This makes sense since it is where companies should tackle priority improvement and implementation first and foremost.

The next regularly recurring activity is “Candidate / Employee Experience Survey Feedback,” which also resonates with us and the benchmark research work we do, and of course to be able to measure the impact of candidate/employer experience on employers and their brands.

Current staffing and new technologies were also key to employers in December. And speaking of staffing, CandE Pulse respondents said they’ve been hiring. The percentages have been consistently in the 70s to low 80s.

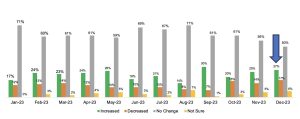

Hiring Status

Granted, the mix of employers responding do vary each month, and it’s not all net new hiring, but seeing stable hiring month after month is promising. Job types that were up in hiring included entry level, professional, and management. However, we have seen regular monthly fluctuations in those freezing hiring, laying, and redeploying, all of which were up in December.

We also ask employers each month whether they’ve increased or decreased the size of their recruiting team this month. While the number decreased significantly during the summer months, increasing the recruiting team size is now up 35% since October.

Increased or Decreased Recruiting Team Size

We also ask each month about the job requisition load, and the monthly average has gone from 77% stating they manage up to 30 reqs each per recruiter in January 2023, to 61% managing up to 30 reqs each per recruiter in December 2023.

Those carrying 31 to 50 reqs each were down significantly in December compared to November, but those carrying over 100 reqs increased 200%. This could be from high-volume hiring across the resilient industries like healthcare and hospitality.

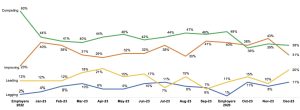

And as we do each year in our benchmark research, and now monthly in our CandE Pulse surveys, we again highlight how employers self-rate their own recruiting and candidate experience and whether or not their leading, competing, improving, or lagging. Those who said they were lagging increased by 38%, while those who said they were improving decreased by 28% — not the trends we want to see, but definitely a continuing road sign of the volatile times.

Otherwise, those who said they were competing remained flat and those who said they were leading increased by 100%, which could be a bright sign, or a delusional one.

Self-Rating Recruiting and Candidate Experience

The employers that respond to our CandE Pulse surveys each month vary, but we do know that no matter the mix, consistent recruiting and hiring while sustaining a quality candidate experience is difficult for most companies. But there are those multi-year CandE Award winners that do it year after year (those employers that have above average ratings in our benchmark research, which ultimately is still a much smaller subset overall). We’ll cover the CandE Winner differentiators throughout our 2023 CandE Benchmark Research Reports once available very soon.

In the meantime, it’s good to know that improving candidate experience is still an off-ramp rest-stop priority, but it can be too difficult to get there when stuck in recruiting frustration gridlock. To improve processes and optimize recruiting technologies, you need the right road sign metrics and data, which is why we highly recommend that employers participate in our CandE Benchmark Research Program.

Finally, according to one of our 2023 CandE Winners, Delaware North, (excerpt from a coming case study): “To build support within our organization, we’ve tied our candidate experience to the guest experience which is vital to our business. By explaining that a poor candidate experience can result in the loss of a guest for our businesses, we were able to put a dollar amount on the potential loss of revenue due to poor candidate experience.“

It’s time to trade in 2023 and rev that 2024 recruiting engine on the open road by improving your recruiting processes and your candidate experiences.