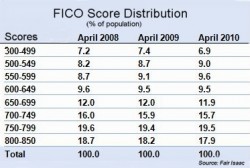

With the U.S. beginning its fourth year of a sour economy that is taking its toll on consumer credit scores, the EEOC signaled this week that it is taking a hard look at employers who use credit checks as a screening tool.

With the U.S. beginning its fourth year of a sour economy that is taking its toll on consumer credit scores, the EEOC signaled this week that it is taking a hard look at employers who use credit checks as a screening tool.

Kaplan Higher Education Corp. was sued Tuesday by the Equal Employment Opportunity Commission over its use of credit checks. The suit claims Kaplan denied jobs based on credit histories in such a way that it had a disparate impact on blacks.

The EEOC said Kaplan “engaged in a pattern or practice of unlawful discrimination by refusing to hire a class of black job applicants nationwide.”

“This practice has an unlawful discriminatory impact because of race and is neither job-related nor justified by business necessity.” The types of jobs at issue weren’t disclosed.

A company spokeswoman denied the charge, saying background checks are conducted on all potential employees. Credit checks are part of the screening for jobs involving financial matters, including advising students on financial aid.

A “disparate impact” case doesn’t require an employer to have intentionally discriminated against a class of applicants. Instead, discrimination can occur by the use of background criteria, experience, education, or other job requirements that appear neutral on their face but which more heavily impact a protected class of applicant. Unless the employer can demonstrate a “business necessity” for the requirement, it may be found guilty of discriminating. Even where business necessity can be established, a violation may still be found if there is another alternative available that is less discriminatory.

Labor lawyers and industry experts have been predicting that the EEOC is becoming more aggressive. Employment attorney Jon Hyman, who blogs at Ohio Employer’s Law Blog, warned last month that, “The EEOC is no longer an agency where charges go to die. Employers can expect more thorough investigations, quicker resolutions, and more aggressive enforcement.”

![]() Nick Fishman, chief marketing officer, VP and co-founder of EmployeeScreenIQ, blogged about this same thing recently on ERE. In his look ahead at the background screening trends for 2011, Fishman listed the EEOC aggressiveness first, writing: “The EEOC is especially targeting ‘bright line’ hiring decisions that automatically exclude candidates with criminal records, arrest records that don’t result in a conviction, and/or poor credit.”

Nick Fishman, chief marketing officer, VP and co-founder of EmployeeScreenIQ, blogged about this same thing recently on ERE. In his look ahead at the background screening trends for 2011, Fishman listed the EEOC aggressiveness first, writing: “The EEOC is especially targeting ‘bright line’ hiring decisions that automatically exclude candidates with criminal records, arrest records that don’t result in a conviction, and/or poor credit.”

After reading about the Kaplan suit this morning, I called Fishman to ask about the issue and for advice about what recruiters can do to insulate their company against EEOC action.

He wasn’t surprised that the EEOC had sued someone over the issue. “They’ve become a lot more active in the last year,” he said.”We’re going to see a lot more out of them.” And, he pointed out, there is no way to protect against someone filing a lawsuit. However, no employer should be deterred from credit or background checks where the job demands it and there’s no intent to discriminate.

Fishman offered this guidance:

- Assess the exposure the company has for each job.

- Make sure there is a legitimate business purpose to conduct a credit check. Do the job responsibilities involve financial records or access to them? For a CFO position, the connection is clear. For a janitorial job, maybe not. Though there might be situations where a janitor has access by virtue of a master key to money or records.

- Have a written background policy for each position, including a description of the business purpose.

- If adverse credit information turns up, don’t automatically reject the candidate. Instead, ask about it.

Through conversations with clients and others in the industry, he has learned that employers these days are more sympathetic to credit problems. Even in the gaming industry, where many employees routinely deal with large amounts of cash, applicants with credit dings are getting more consideration than in the past, if for no other reason than credit problems are so pervasive.

Nevada, the gaming capital of the U.S., has the lowest average credit score in the nation. At 668, it’s 24 points below the national average of 692. No wonder, considering that Las Vegas has the highest foreclosure rates in the nation.

Nevada, the gaming capital of the U.S., has the lowest average credit score in the nation. At 668, it’s 24 points below the national average of 692. No wonder, considering that Las Vegas has the highest foreclosure rates in the nation.

Two months ago, the EEOC held a public meeting on the use of credit histories as employment screening devices. It heard from a number of organizations including SHRM, which concluded its presentation saying, “SHRM has significant concerns with efforts to eliminate the ability of employers to consider relevant credit information during the employment process.”

Most of the speakers at the meeting represented private organizations and advocacy groups; however, the comments by Richard Tonowski may foreshadow just what the EEOC wants to see from employers using credit checks and background screening generally. Tonowski, the EEOC’s chief psychologist, summarized the day’s proceedings listing four distinct reasons why employers use credit checks.

These are:

- To identify productive employees, a use he said that has “little evidence” to back it up;

- To identify reliable employees. Conceding there is “some evidence” correlating good credit with reliability, he said, “Similar results might be obtained through personality tests or their close cousins, integrity tests.” Interestingly, these, he noted, may soon be examined by the EEOC for having a potential adverse impact on protected classes;

- To confirm employment history, which, though “a credit report can confirm basic information” the same “might be obtained from background screening providers without the applicant’s financial details”;

- To identify those with incentive for major fraud or theft.

When used to identify potentially dishonest employees, Tonowski said, “This is perhaps the most problematic use, because — fortunately — serious crime is likely a rare event for most employers. It is thus hard to establish a predictive relationship between credit and crime.”

While hearing from the EEOC is enough to cause any HR professional to shudder, even if it decides not to proceed, private actions may be allowed. Two weeks ago the University of Miami was sued over the denial of a job to a black applicant because of a credit check.