Since mid-September, we’ve been delivering our CandE data reviews to this year’s participating employers in our benchmark research program. Anecdotally, we’re hearing that larger employers with significant high-volume hiring are experience an increase in applicant volume. And for some, that’s causing a bottleneck declination delay in responding to those applicants not qualified, even with the available recruiting automation many employers have.

It’s true that candidate resentment has increased globally in our benchmark research data this year — the percentage of candidates that felt like they had a horrible candidate experience and aren’t willing to ever engage a business again because of that. But we’re not seeing a dramatic increase in the percentage of job candidates who applied and haven’t heard anything for 1-2+ months. It’s still a lot of candidates when you project outward from our candidate responses, and for the past 3 years, these are those percentages in North America:

- 2023 – 37%

- 2022 – 34%

- 2021 – 38%

This is a tough place for employers and candidates alike — a rock and a hard place. For many job candidates at the point of application, they’re just not qualified enough for the roles they’re applying for to be screened further. In fact, over 60% of hourly candidates across industries in this year’s benchmark data weren’t screened beyond the application stage. It’s the same for professional hires. It’s a very limited candidate experience for most.

Through it all, job growth continues, with employers adding 336,000 jobs in September, with healthcare, hospitality, education, factories, and construction among the industries that added the most jobs. The unemployment held steady at 3.8 percent and job gains for July and August were also revised substantially higher. It will also be interesting to see how all the strike impacts show up in these numbers next month.

Just as we pointed out in last month’s CandE Pulse update and above, candidate resentment is on the rise again globally. We ended up with nearly 240,000 global candidate responses in this year’s program and 90% of them didn’t get hired, which reflects real world recruiting. The number of candidates across job types who told us that they had a “great” experience this year has declined significantly.

The great experience being positive and fair enough for the candidate to be willing to apply again, refer others, be a brand advocate, and/or be a customer (see Figure 1). The poor experience, or candidate resentment rate as we call it, is the percentage of candidates who won’t apply again, refer others, be a brand advocate, and/or be a customer (see Figure 2).

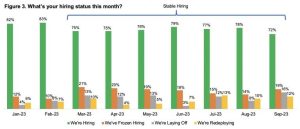

In our latest CandE Community Pulse results for September, the good news is that hiring continues to be stable and again reflects the bigger jobs reports the past few months, although it’s down slightly. We had over 100 responses from companies big and small across industries (over 60% this time were 500-100,000+ in employee size, and the most represented industries were healthcare, education, finance & insurance, manufacturing, technology, and nonprofit).

When we asked employers what their current hiring status was, 72% said “we’re hiring,” down slightly from August, but still consistently stable over the past seven months (see Figure 3). However, freezing hiring, laying off, and redeploying were all up in September.

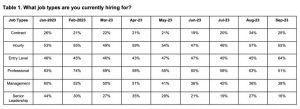

All job types being hired for decreased in September, except for entry level and management jobs (see Table 1). We also asked employers whether they’ve increased or decreased the size of their recruiting team this month, and those stating they’ve increased is up 114% (see Figure 4). This is opposite of what we keep hearing anecdotally, that recruiters continue to be let go. We’ll see if it’s a trend that continues into October.

The job requisition load of up to 30 reqs each per recruiter stayed about the same in September from August at 74%. Those carrying up to 50 reqs each was down slightly from August. Of course, while we want to assume this could be a sign of growth, we understand that req loads always vary by job type, industry, and employer size, and again the fact that many recruiting teams are stable but leaner these days.

As we do each year in our benchmark research, and now monthly since January, we again highlight how employers rated their own recruiting and candidate experience. When we compare the September CandE Pulse results to August, those companies that felt like they were leading in their recruiting and hiring practices and their candidate experience dropped significantly by 53% (see Figure 5). But when you compare that against our 2023 annual employer benchmark responses, it increases again by 57%.

Because of the limited number of survey questions and the different mix of companies that respond each month to our pulse surveys, and the fact that these are self-ratings, we do have to be careful of what exactly is really going on. However, it does tell us self-awareness of how employers are delivering recruiting experiences can definitely fluctuate. Those that said they were competing continues to be stable, which is what we like to see. But those who said they were improving increased 37% from August. Lagging also decreased, which is also what we like to see.

Also, according to our September monthly CandE Pulse results, candidate experience jumped back to the #1 recruiting and hiring initiative for those employers that responded. And it’s been the only constant in the top 5 since December (and historically in our annual recruiting priorities). Referrals jumped to #2 (see Table 2). We’re surprised that referrals haven’t been more of a constant in these priorities.

Diversity and inclusion is again #3, analytics and data management landed at #4 (hasn’t been in the top 5 since March), and employer branding came in at #5.

When it comes to the top five ways employers are accomplishing the above priorities, improving processes remains at #1. And for the past nine months, candidate and employee survey feedback has helped inform employers where recruiting, hiring, and retention improvements need to be made (see Table 3). Current staffing and more staffing are both in the top 5 in September as well, the first time since June. As we saw above, employers told us in September they increased their recruiting teams, so again, we’ll see if that continues into October.

The employers that respond to our CandE Pulse survey each month vary, but we do know that no matter the mix, consistent recruiting and hiring while sustaining a quality candidate experience is difficult for many. We’ll keep sharing these key Pulse indicators with everyone each month. Also, our 2023 CandE Benchmark Research Reports will be available by the end of the year.

We’ve worked hard to make a difference with our candidate experience benchmark research for the past 12 years, to help companies improve their recruiting processes and candidate experiences. Unfortunately, there is only a small universe of companies that consistently improve and sustain, and for too many employers and job candidates, recruiting does feel like a rock and a hard place.

Blessings to those who make it less so.

Until the next monthly CandE Pulse results update, be safe and well. Be sure to take our October CandE Pulse Survey to help us stay up to date on the recruiting and hiring landscape today.