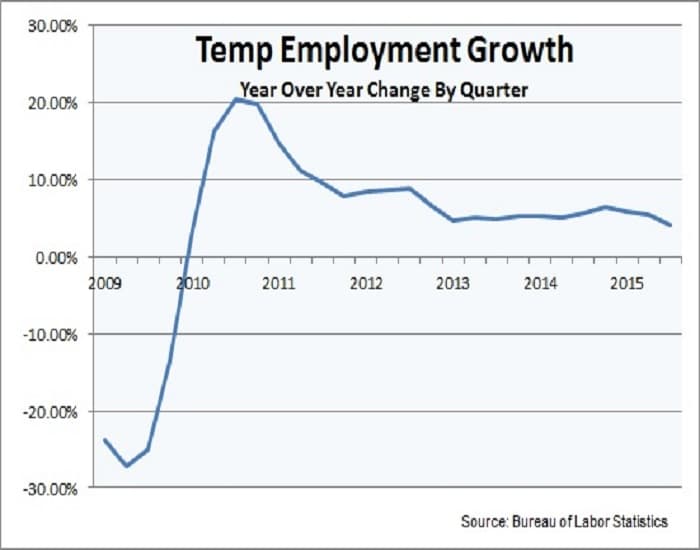

Temp worker growth is forecast to slow significantly in this last quarter of 2015, after aggressively growing since 2010.

The Palmer Forecast predicts temp will grow by 2.9% in the fourth quarter when compared to the same quarter last year. If the Forecast is correct, it will be the slowest quarterly increase in more than five years.

“Our temporary help forecast for the 2015 fourth quarter continues to demonstrate growth, although the growth is slowing as compared with previous quarters,” said Greg Palmer, founder and managing director of G. Palmer & Associates, a California-based human capital advisory firm. “The data shows that temp help as a percentage of new job growth is tapering off, which indicates the likelihood of increases in pricing, margins, direct hire and conversion fees in the staffing industry.”

The Palmer Forecast measures the number of new temp workers hired by agencies, which is a direct indication of the demand by employers for more workers. Hiring by the staffing sector is considered a key economic indicator. Contingent (temp) workers hired directly by employers is significantly larger, but is even more highly seasonal than the agency workforce.

Since the end of the recession (officially in June 2009), staffing agency employment has grown from 1.752 million (1.756 million not seasonally adjusted) to 2.906 million in September (2.979 million unadjusted). With only one exception (Q1 2013), the industry’s workforce has never grown less than 5% on a quarter over quarter basis. Between the second quarter of 2010 and the 3rd quarter of 2011, the temp workforce grew at double-digit rates.

But since this year, growth began to slow noticeably. In the first nine months the temp agency workforce grew by 42,800 workers (seasonally adjusted). A year before, 113,300 workers were added.

The American Staffing Association’s Staffing Index reflects the slowdown. For the week ending Sept 27th, the index decreased to 100.38, 3.5% below where it was a year ago. This is more significant than it might appear at first glance. At the current rate of change, the Index will end the year lower than it was a year ago, the first time that’s happened since 2012.

The American Staffing Association’s Staffing Index reflects the slowdown. For the week ending Sept 27th, the index decreased to 100.38, 3.5% below where it was a year ago. This is more significant than it might appear at first glance. At the current rate of change, the Index will end the year lower than it was a year ago, the first time that’s happened since 2012.