Third quarter financial reports are coming in for the publicly held recruiting industry vendors and the results show that the world economic condition is beginning to have an effect.

HR technology providers Taleo (profile; site), Kenexa (profile; site) and SuccessFactors (profile; site), all of whom reported this week, mostly beat or matched Wall Street’s expectations for the quarter. Only Kenexa took a hit when it reported earnings that were lower than the same quarter in 2007.

Both Kenexa and Taleo said they expected the fourth quarter to be tougher and issued financial projections showing a reduction in earnings per share from the third quarter, which ended Sept. 30.

Taleo lost $8.2 million for the third quarter, compared to net income of $2.2 million for the same period last year. The company said this was “primarily from restructuring charges and amortization expense related to the acquisition of Vurv.” Kenexa meanwhile earned $5.4 million and expects to earn between $6.3 million and $7 million for the fourth quarter. That doesn’t take into account a hit of $2 million to $2.5 million. That’s what the company expects it will cost to reduce its workforce by a planned 12 percent.

Those numbers are below what Wall Street was expecting, sinking Kenexa’s stock price to a 52-week low.

SuccessFactors, which has been losing ever-increasing amounts since 2004, was the only one of the three companies to say it expected improvement in the fourth quarter. The company expects revenue for the quarter to be in the $31.0 million to $31.5 million range. For the year, it raised its earlier projection and now says the company will bring in between $109.9 million to $110.4 million. Even with the improving numbers SuccessFactors will show a loss for the year op $1.32 to $1.34 per share.

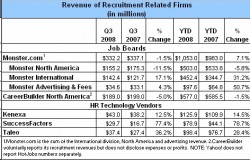

On the job board side, both Monster (profile; site) and privately-held CareerBuilder (profile; site) (which voluntarily reports some numbers) showed a drop in North American revenue. Monster, which released its numbers last week, had total revenue of $332.2 million with the U.S. and Canada contributing $155.2 million of the total. The balance came from its international sales ($142.4 million) and from advertising and fees ($34.5 million). CareerBuilder, which only reports its North American revenue numbers, had $189.9 million.

Both companies’ North American job posting income was down from the same quarter in 2007. Careerbuilder was off $10 million. Monster was down $20 million. Monster’s profit rose, however, to $42.8 million, or 35 cents per share, compared with $33.3 million, or 26 cents on more shares, ifor the same period last year. Despite the news, some analysts downgraded Monster’s stock rating, fearing that a continuing recession will dampen the company’s overall earnings prospects for at least the next quarter.