Apologies upfront, but I am probably going to get a bit pedantic here. We know that there are numerous metrics and measurements in the TA space, and we also know that a relatively small percentage of those matter to key executive stakeholders outside of TA and hiring managers.

Apologies upfront, but I am probably going to get a bit pedantic here. We know that there are numerous metrics and measurements in the TA space, and we also know that a relatively small percentage of those matter to key executive stakeholders outside of TA and hiring managers.

As a leader, one of the most critical metrics for you and those key stakeholders is Hiring Velocity, which is what I consider a macro metric, meaning this is not of interest to your hiring managers, but will be very interesting to your C-suite.

This metric correlates with business effectiveness by looking at impact against inventory. Most sizable companies will never be at 0 openings. A 10,000 person company with 8 percent annual turnover will open an average of 67 positions a month, for example. The question is, are those 67 openings translating into an annually growing req load, or are you keeping up, or getting ahead?

Now here is where I’m going to get pedantic: Hiring Velocity Is Not Time to Fill or Time to Hire! In measuring time to fill, the results inform the time. In measuring Hiring Velocity, time constrains the results. If this is confusing, then you should first understand that velocity is a function of time, but it layers in the concepts of magnitude and direction into the final calculation. The super-simple schoolyard definition: velocity is the speed and direction of something over time.

For a TA leader that “something” is hires, or fills, or placements, or whatever nomenclature you choose. So in order to begin calculating hiring velocity, we have to start with the number of hires in a given time. Now a number in the ether is a bit useless without balance, so the other side of the scale is “positions opened” during that same given time; those two sides of the scale provide your hiring velocity.

The simple calculation is number of positions opened vs. the number of hires over a defined time. So for example if your opened 10 positions this week, regardless of how many are already open and in your inventory, and you filled 12 positions, again regardless whether any of those hires were for the 10 new positions, your hiring velocity would be +2. Your hiring velocity is not dependent on your current requisition inventory or any positions in particular. It is simply the directional force in a given time frame.

Great, but so what? Well let me explain how I measure and use hiring velocity and why high level stakeholders value it.

Measurement Without Reference Is Just a Number

First, figure out what your Hiring Velocity should be, weekly, monthly, quarterly, and annually. Your minimum goal should be to fill as many positions as are opened annually. Remember, you have existing inventory, so this doesn’t mean that you have to fill every position that you open annually, but instead, that your team will fill as many positions as you opened; otherwise you are put into a situation where you are either slowly or rapidly losing ground and continuing to grow your inventory. Optimally, your goal is to exceed that number, but you have to be sure you can walk before you run.

In order to determine my starting point, I look at our headcount planning and historical turnover and then determine what our anticipated number of openings will be for the given year. This is not a perfectly accurate calculation, but I monitor and adjust the planning quarterly or monthly. So for the sake of our exercise let us say that our anticipated number is 5,200 positions opened this year, and we have a current inventory of 100 open requisitions. Therefore the goal of the TA team is to fill at least 5,200 positions this year.

Now for Some Arithmetic

In order to cast weekly, monthly, and quarterly goals, all I do now is simple division (now you see why I chose the hypothetical number I did!), first dividing the total by 52. This give us a weekly goal of 100 hires a week. Divide 5,200 by 4 to get your quarterly, which is 1,300. For monthly I use the 4-4-5 model. So within each quarter two months have goals of 400 and one has a goal of 500 (accounting for the 13 weeks in the quarter). Goals set!

Great. Now What?

Obviously your team needs to be aware of what their goals are as a team and as individuals. Note that individual goals may vary based on recruiter experience and types of positions they recruit for.Tteam goals may vary based on recruiting lane. But, regardless, the total of each individuals and teams goals should add up to the total TA Velocity goal.

These are annual goals, and there may be wild variation week to week. You will rarely land “on target” during a week, but you should expect smoother numbers monthly and smoother still quarterly. This is why I suggest making adjustments on a quarterly basis. If you didn’t hit the goal you have to recalculate and push the missed numbers ahead. If there is a seasonal change or a market factor that is impacting your work, perhaps factor those in as well.

Your Stakeholders Love This Metric Because It Represents Meaningful Production

Time to fill is a dreadful measure of TA performance outside of the C recruiting lane, and yet it is still is a number most TA leaders want to make their stakeholders aware of, and the one that they feel is most indicative of their success as a leader. However, time to fill doesn’t take into account your total inventory, which makes it at best a shaky measure of success.

However, when you want to present meaningful data, report on the number of openings vs. the number of fills — your Hiring Velocity — that’s a solid team production metric. Your leaders can understand and appreciate that if the company opened 5,200 positions in the last year and you and your team filled 5,300, that’s a good thing. Not only were you keeping up with demand but you reduced inventory. They have a more accurate understanding of your ability to meet demand and it will allow them to plan accordingly.

If you have enough scale in your hiring, you can break this down into further buckets. I personally like to break down by recruiting lane (if you want the full article, not just the abstract, let me know) and business unit, but that’s my preference.

This is a single metric and as such it is not a be all end all. Combine this with other metrics to produce truly value-added information and to manage your team, but I do consider this one of the “big” metrics you have to report on.

If you have pretty stable annual hiring volume you can also implement this metric on a rolling basis, adding YoY and rolling 12-month measurements.

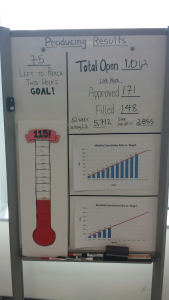

I love using visuals with my teams. Above is an example of how we illustrated Hiring Velocity to a centralized recruiting team.

Special thanks to Taylor Franco, Zach Meiners, Maitana Delgado, and Mahsa Chegini for their review and insight into the article, and thanks to you for reading, sharing, and being part of the talent-acquisition community!