Friday morning the government reported that in March, the U.S. economy added only 120,000 new jobs. That was a surprise to economists and labor analysts, nearly all of whom were expecting the number to be over 200,000.

It was particularly bad news, considering public confidence in the recovery has only recently begun to approach the level of February 2011, w hen it reached its highest point since the Great Recession began. CEO confidence, also as measured by The Conference Board, soared this last quarter by 14 points, signaling an improvement in business outlook.

hen it reached its highest point since the Great Recession began. CEO confidence, also as measured by The Conference Board, soared this last quarter by 14 points, signaling an improvement in business outlook.

So the March job growth numbers — the lowest in five months — may be read as a sign the recovery is sputtering. If consumers react by tightening their discretionary buying, it can trigger a downward spiral.

Cautious employers can be forgiven if they react as if the Labor Department report were an omen. Last year, in the first four months, the economy added 913,000 jobs, with each month larger than the previous. In May, growth fell off a cliff when 54,000 new jobs were created. It was five months before new job creation broke 100K.

What does this mean for third party recruiters? That’s hard to tell at this point. The Bureau of Labor Statistics doesn’t track placements. In its monthly jobs snapshot, the best it does is offer some top line numbers; more granular data runs a month behind.

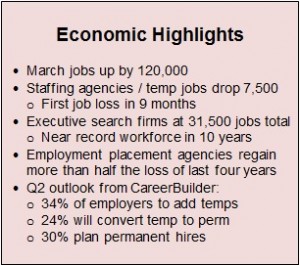

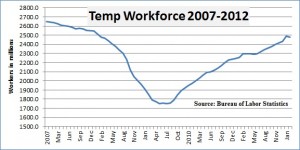

Reading these tea leaves, there’s a hint history may repeat itself. In March, the staffing industry showed its first jobs decline in nine months. There were 7,500 fewer temp workers last month than in February. For an sector with 2.5 million workers, March’s loss might be seen as a blip. were it not for April, May, and June of last year when staffing growth turned negative after 19 consecutive months of increases.

Reading these tea leaves, there’s a hint history may repeat itself. In March, the staffing industry showed its first jobs decline in nine months. There were 7,500 fewer temp workers last month than in February. For an sector with 2.5 million workers, March’s loss might be seen as a blip. were it not for April, May, and June of last year when staffing growth turned negative after 19 consecutive months of increases.

When growth turned up again in July, it was slower in each of the next two quarters than in the year’s first, when the staffing industry added 66,100 positions. Even with the negative March growth, staffing firms added almost 84,000 jobs in the first quarter.

The government also tracks employment at executive search firms. But unlike staffing hires, the month-to-month changes in search offer little in the way of predictive insight. On an annual basis, however, the industry has been adding workers. In February, there were 31,500 workers employed by search firms. That’s 700 more than the average for all of last year.

The challenge in looking at employment in search firms is to decide how much of the change is impacted by corporate in-sourcing of search, versus economic belt-tightening, versus business expansion. In that light, it probably is of significance to note there are more jobs at executive search firms today than at almost any other time in the last 10 years. From that, it seems safe to say that whatever trend there is for corporations to in-source their executive and other hard-to-fill positions, it hasn’t impacted search firms as much as some feared.

One other data point is worth looking at, and that’s the number of workers at placement agencies. Counted in this category are employees of chauffeur services, nurse registries, employment firms, state job service offices, casting agencies, and the like.

Changes in employment here provides some indication of economic health. But deciding what the changes mean is tricky, because some placement services — the government offices, for instance — added workers to assist the unemployed as the economy was tanking. That said, there is evidence that employment in this category does move in tandem with general economic conditions. In 2007, just before the official start of the recession, there were an average of 277,400 workers. Two years later, the average fell to 200,200 workers.

Jobs began returning early in 2010 and the growth continued in all but two months of last year. As of February, there were 240,800 workers employed in the employment placement agencies category.

Looking at all the data here and in the accompanying charts, it’s easy to appreciate why Thomas Carlyle called economics the “dismal science.” His reference, of course, had little to do with the challenge of predicting next quarter’s labor demand based on the data breadcrumbs gathered by the Bureau of Labor Statistics. It does, though, summarize the reliability of the monthly economic predictions analysts make.

CareerBuilder offers an optimistic view of the next quarter. After surveying some 2,300 HR professionals and hiring managers, CareerBuilder says 30 percent of employers plan to increase their full-time, permanent workforce. Even more — 34 percent — expect they’ll bring on more temps and contract workers.

In Q1, 37 percent of employers hired more temps, an eight point increase over the 29 percent who hired temps in Q1 last year.

Independents with strong candidates, but no job orders for them, will be encouraged by another of CareerBuilder’s findings. The company says 31 percent of employers report not being to find qualified employees to fill open jobs. That’s up from the 24 percent who said that last year.