The worse-than-expected jobs report from the government today has so far done little to stimulate action on the stimulus bill that’s still in the taffy-pulling stage in the U.S. Senate. Even Wall Street pretty much shrugged off the news that 600,000 jobs were lost in January, the most since 1974. At midday the Dow was up 153 points, extending its Thursday rally on the strength of hope the U.S. Senate will approve something by tonight.

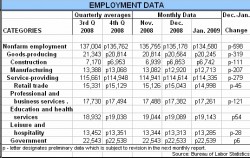

The monthly jobs report from the Bureau of Labor Statistics described the U.S. situation in surprisingly gloomy words for bureaucrats. Noting that the unemployment rate rose .4 points in one month — from 7.2 in December to 7.6 percent nationwide at the end of January – the BLS report said in its very first paragraph: “In January, job losses were large and widespread across nearly all major industry sectors.”

The monthly jobs report from the Bureau of Labor Statistics described the U.S. situation in surprisingly gloomy words for bureaucrats. Noting that the unemployment rate rose .4 points in one month — from 7.2 in December to 7.6 percent nationwide at the end of January – the BLS report said in its very first paragraph: “In January, job losses were large and widespread across nearly all major industry sectors.”

The only job categories to show growth were Education and Health Services, up by 54,000 jobs, and Government, which grew by 6,000 jobs. Construction and manufacturing together lost 318,000 jobs.

The 11.6 million Americans now officially out of work represent mostly those still actively looking for work. Discouraged workers who have given up, even temporarily, looking for work, and those working part-time because they can’t find full time jobs come to almost 10 million more. If those workers were counted as part of the unemployed, the unemployment rate would be closer to 15 percent.

In Washington, Senate negotiators have trimmed somewhere between $70 and $80 billion from the stimulus bill, depending on when and to whom reporters were talking. The latest report from the Wall Street Journal says that a bipartisan group was working to get the stimulus bill closer to the $800 billion floor the Administration insists is the minimum it will accept. That would necessitate finding as much as $45 billion more to take out of the bill that by some estimates has mushroomed to $935 billion. However, negotiators expect the final cuts to amount to $100 billion.

There is one bright spot: Oil is down on the New York Mercantile Exchange to under $40 a barrel. That’s the first time since 2005 it has been so low.